U.S. Health Insurance Industry | 2020 Annual Results

1 | P a g e

© 2021 National Association of Insurance Commissioners

U.S. Health Insurance Industry Analysis Report

HEALTH INDUSTRY OVERVIEW

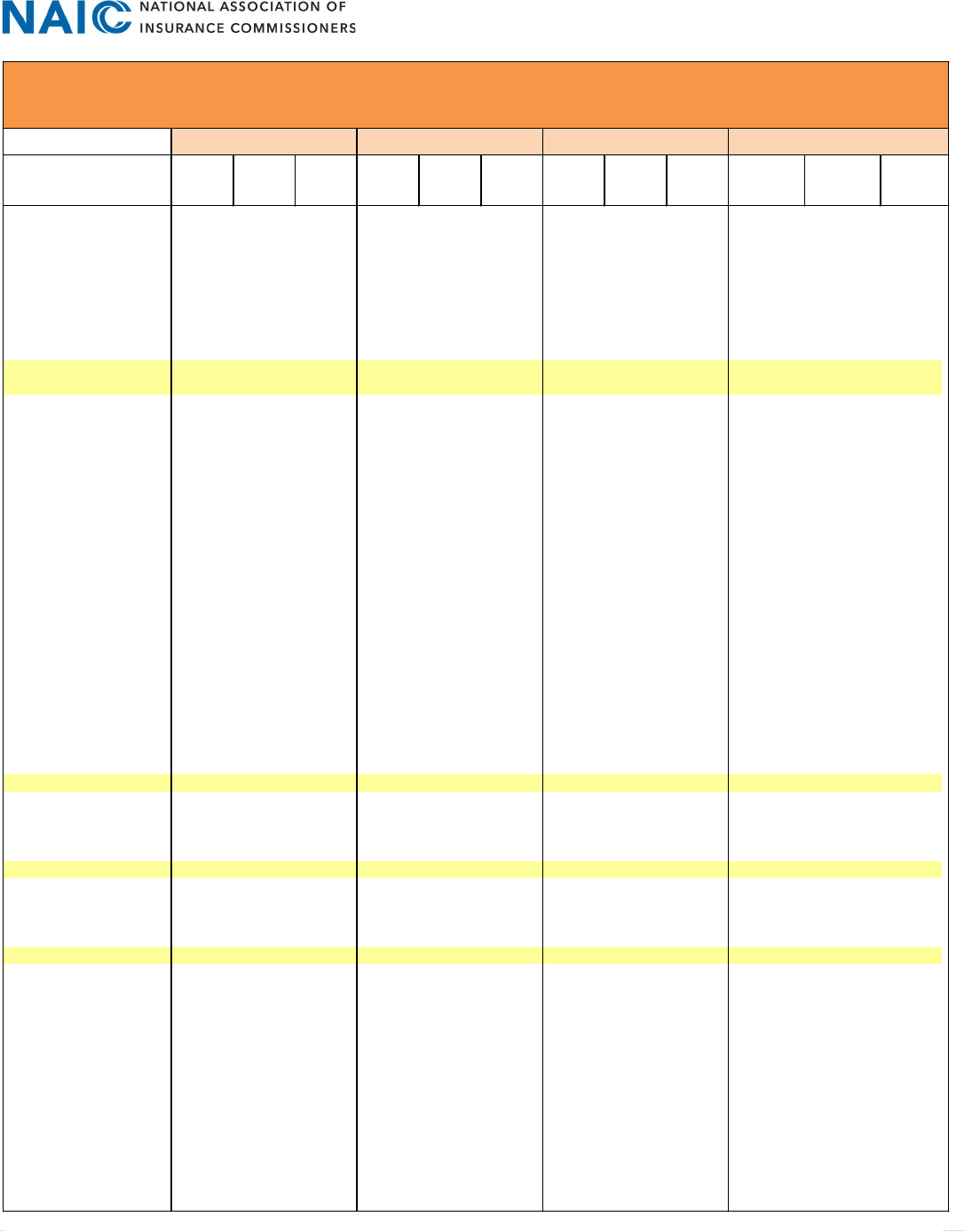

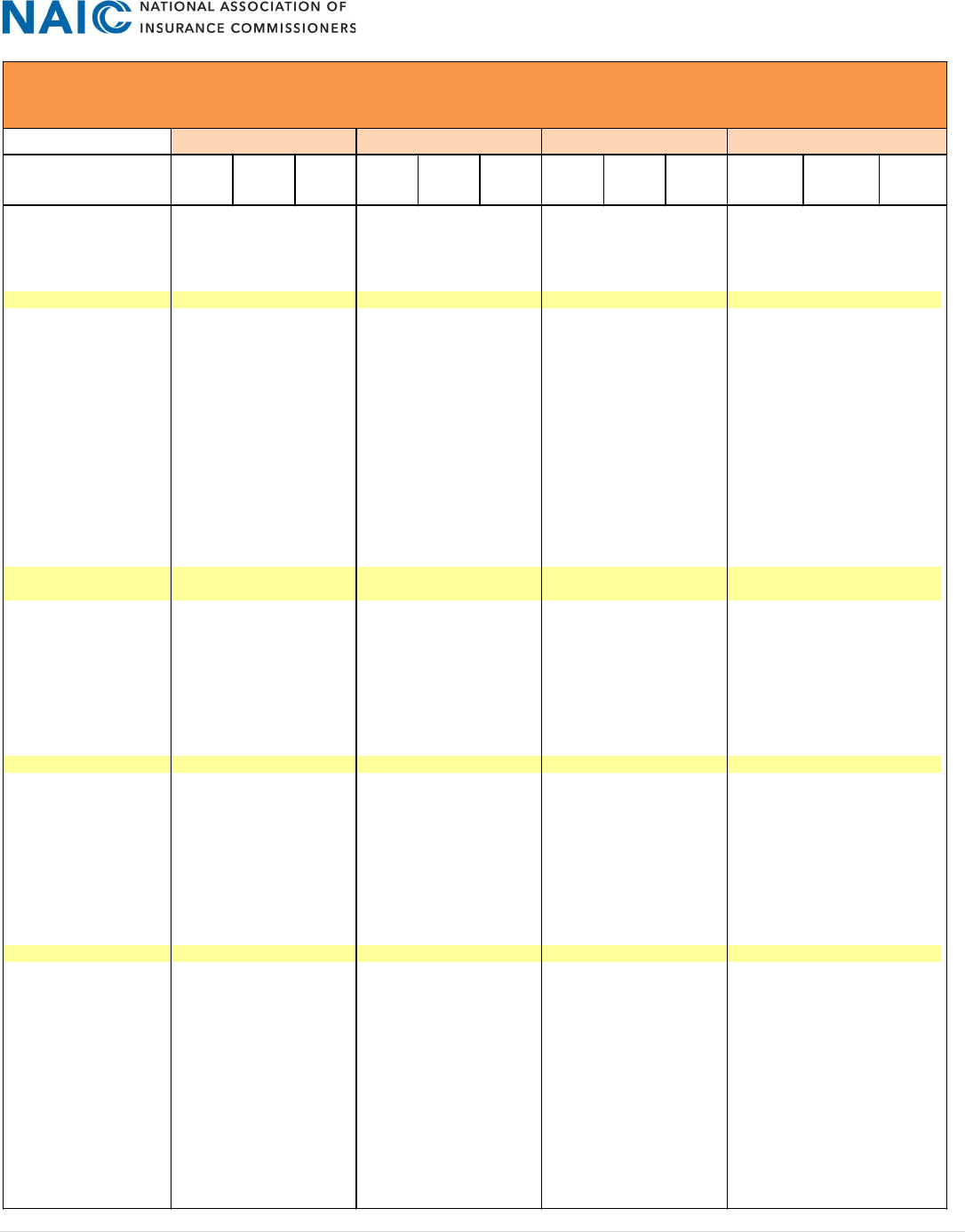

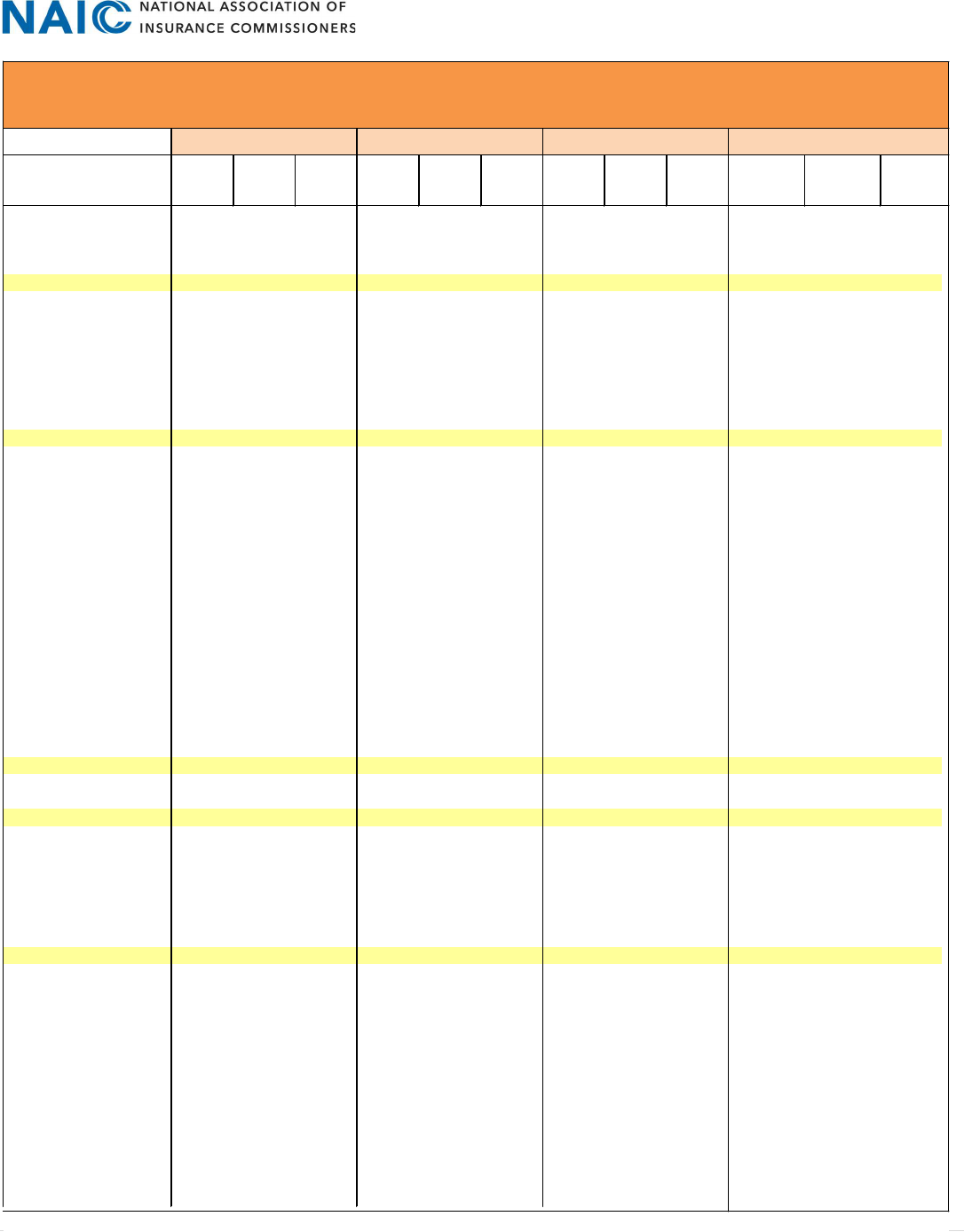

Table 1 below provides a 10-year snapshot of the U.S. Health insurance

industry’s aggregate financial results for health entities who file with the

NAIC on the health annual statement blank. The number of Health insurers

filing the health statement type with the NAIC increased to 1,096 from 1,031

in 2019. The health insurance industry continued its tremendous growth

trend as it experienced a significant increase in net earnings to $31 billion

and an increase in the profit margin to 3.8% in 2020 compared to net

earnings of $22 billion and a profit margin of 3% in 2019. The combined ratio

decreased modestly to 97% from 97.6%.

Notable items as compared to 2019 include the following:

Net earned premium increased 11% ($81.2 billion).

Hospital & medical expenses increased 6.6% ($42 billion).

Aggregated loss ratio decreased to 82.6%.

Administrative expenses increased 25.3% ($22.2 billion).

Capital and surplus increased 12.6% ($19.7 billion)

A&H earned premium increased 7% ($67.2 billion).

(For insurers filing the A&H Policy Experience Exhibit on the life/

A&H, health, and property/casualty financial statements)

Impact of COVID-19 on Health Insurance Industry

(In Millions, Except PMPM)

Chg. 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011

Operations

Direct Written Premium

8.3%

$824,728

$761,738

$716,190

$668,521

$638,259

$593,403

$533,083

$459,274

$443,537

$418,482

Net Earned Premium

11.0%

$816,208

$734,993

$708,473

$664,107

$631,656

$587,374

$526,852

$450,737

$433,211

$409,291

Net Investment Income Earned

(17.9)%

$4,997

$6,083

$5,146

$4,798

$3,331

$3,250

$3,229

$3,152

$3,154

$3,245

Underwriting Gain/(Loss)

86.7%

$32,970

$17,656

$21,423

$188,358

$9,918

$6,438

$6,618

$9,637

$11,675

$14,763

Net Income/Loss

41.6%

$31,385

$22,168

$23,142

$16,060

$7,194

$3,672

$5,661

$9,978

$11,744

$13,909

Total Hospital & Medical Exp

6.6%

$674,426

$632,412

$598,130

$568,576

$541,886

$505,506

$450,823

$389,206

$371,947

$346,059

Loss Ratio

(3.2) Pts.

82.6%

85.8%

84.0%

85.4%

85.4%

85.6%

85.3%

85.8%

85.7%

84.5%

Administrative Expenses

25.3%

$109,750

$87,596

$92,628

$78,499

$82,633

$78,712

$71,538

$54,705

$51,221

$48,682

Admin Expense Ratio

1.5 Pts.

13.4%

11.9%

13.0%

11.8%

13.0%

13.3%

13.5%

12.1%

11.8%

11.9%

Combined Ratio

(1.6) Pts.

96.0%

97.6%

97.0%

97.2%

98.4%

98.9%

98.8%

97.9%

97.3%

96.4%

Profit Margin

0.8 Pts.

3.8%

3.0%

3.2%

2.4%

1.1%

0.6%

1.1%

2.2%

2.7%

3.4%

Net Premium PMPM

6.0%

$284

$268

$261

$248

$241

$232

$221

$212

$205

$204

Claims PMPM

2.2%

$236

$231

$220

$213

$207

$199

$189

$183

$177

$173

Cash Flow from Operations

124.3%

$55,347

$24,674

$17,046

$25,435

$12,266

$6,600

$6,273

$8,120

$13,203

$15,399

Enrollment

3.9%

240

231

225

221

218

213

204

178

177

168

Capital and Surplus

Capital & Surplus

12.6%

$175,596

$155,944

$151,793

$137,686

$122,392

$115,561

$112,193

$111,140

$103,041

$94,642

Return on Equity (ROE)

3.6 Pts.

18.5%

14.9%

15.8%

11.9%

6.1%

3.7%

5.7%

10.0%

12.4%

15.5%

Assets

Net Invested Assets

22.1%

$278,475

$228,100

$217,909

$210,825

$189,241

$177,180

$169,991

$163,439

$155,331

$145,706

Net Admitted Assets

16.7%

$375,598

$321,761

$305,218

$289,601

$268,386

$253,277

$238,913

$214,328

$201,801

$188,664

Net Inv Inc & Realized Gain/(Loss)

(14.7)%

$6,585

$7,718

$5,175

$5,438

$4,320

$4,165

$4,832

$4,479

$4,417

$4,249

Investment Yield

(0.7) Pts.

2.0%

2.7%

2.4%

2.4%

1.8%

1.9%

1.9%

2.0%

2.1%

2.3%

Number of Companies Filed

1,096

1,031

1,010

981

967

958

943

926

880

857

Table 1

Health Entities as of December 31, 2020

Note: Aggregate results include only health entities who file annual health statements with the NAIC.

Inside the Report Page No.

Industry Overview ................................... 1

Underwriting Results ............................... 2

Analysis of Operations by LOB ................ 3

Enrollment and Premium Revenues ........ 9

Cash Flow and Liquidity ......................... 11

Capital and Surplus ................................ 12

Accident and Health .............................. 23

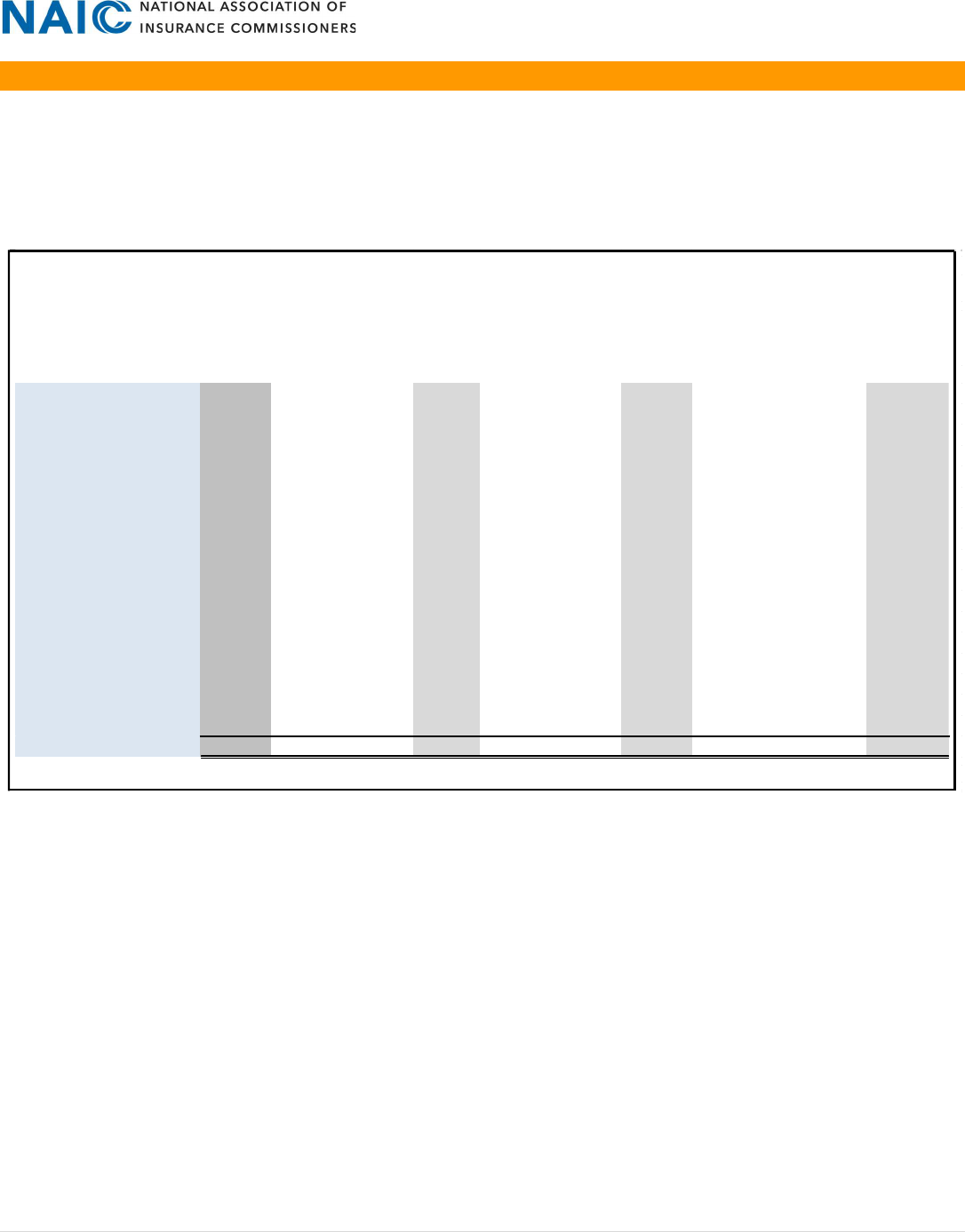

857

880

926

943

949

967

981

1,010

1,031

1,096

'11 '12 '13 '14 '15 '16 '17 '18 '19 '20

Health Entities Filing to the NAIC

U.S. Health Insurance Industry | 2020 Annual Results

2 | P a g e

© 2021 National Association of Insurance Commissioners

UNDERWRITING RESULTS

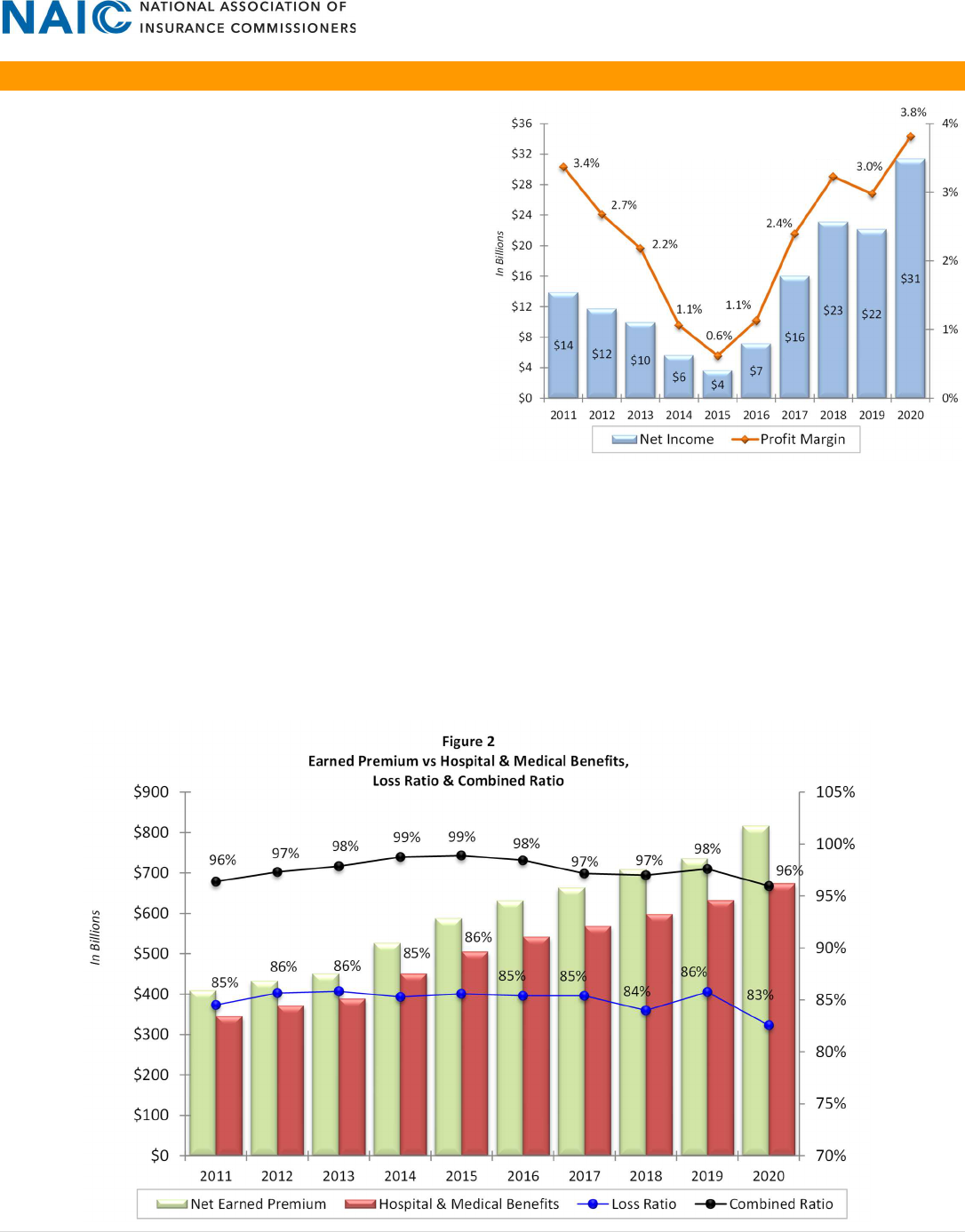

Figure 1 illustrates the profitability trend for the health

insurance industry and the increase in both net earnings

and profit margin. The significant increase in the industry’s

underwriting results can be attributed to an 11% ($81.2

billion) increase in net earned premium to $816.2 billion.

However, the industry partially offset this increase with a

6.6% ($42 billion) increase in total hospital and medical

expenses to $674.4 billion, a 25.3% ($22.2 billion) increase

in claims adjustment expenses and general administrative

expenses to $110 billion. Administrative expenses alone

increased 32.6% ($20.6 billion) to $84 billion due primarily

to the return of the health insurer fee (HIF) which was

expensed in full in the first quarter of 2020 at approximately

$15.5 billion. Health insurers then pass on the HIF to

policyholders via premiums. The industry also reported an

18% ($1.1 billion) decrease in net investment income

earned. The decrease can be attributed to a $752 million decrease in interest income from short-term investments. The

Federal Reserve cut interest rates to 0.25% as the COVID-19 Pandemic disrupted economic activities during 2020.

Figure 2 illustrates the increase in total hospital and medical benefits compared to earned premium. For 2020, the industry

reported a decrease in the combined ratio to 96% due to a 3 basis point decrease in the aggregated loss ratio to 83%

partially offset by the aforementioned increase in administrative expenses.

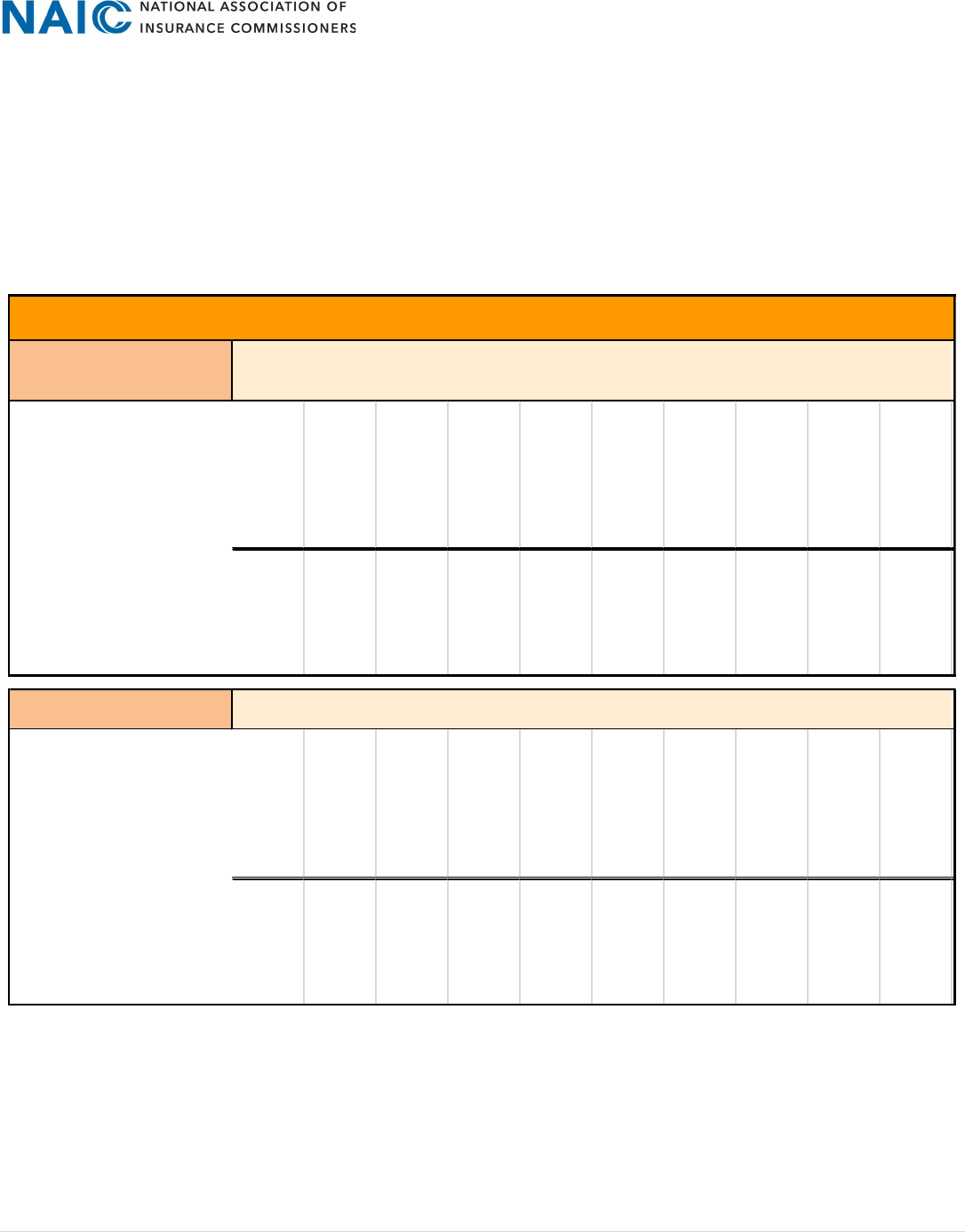

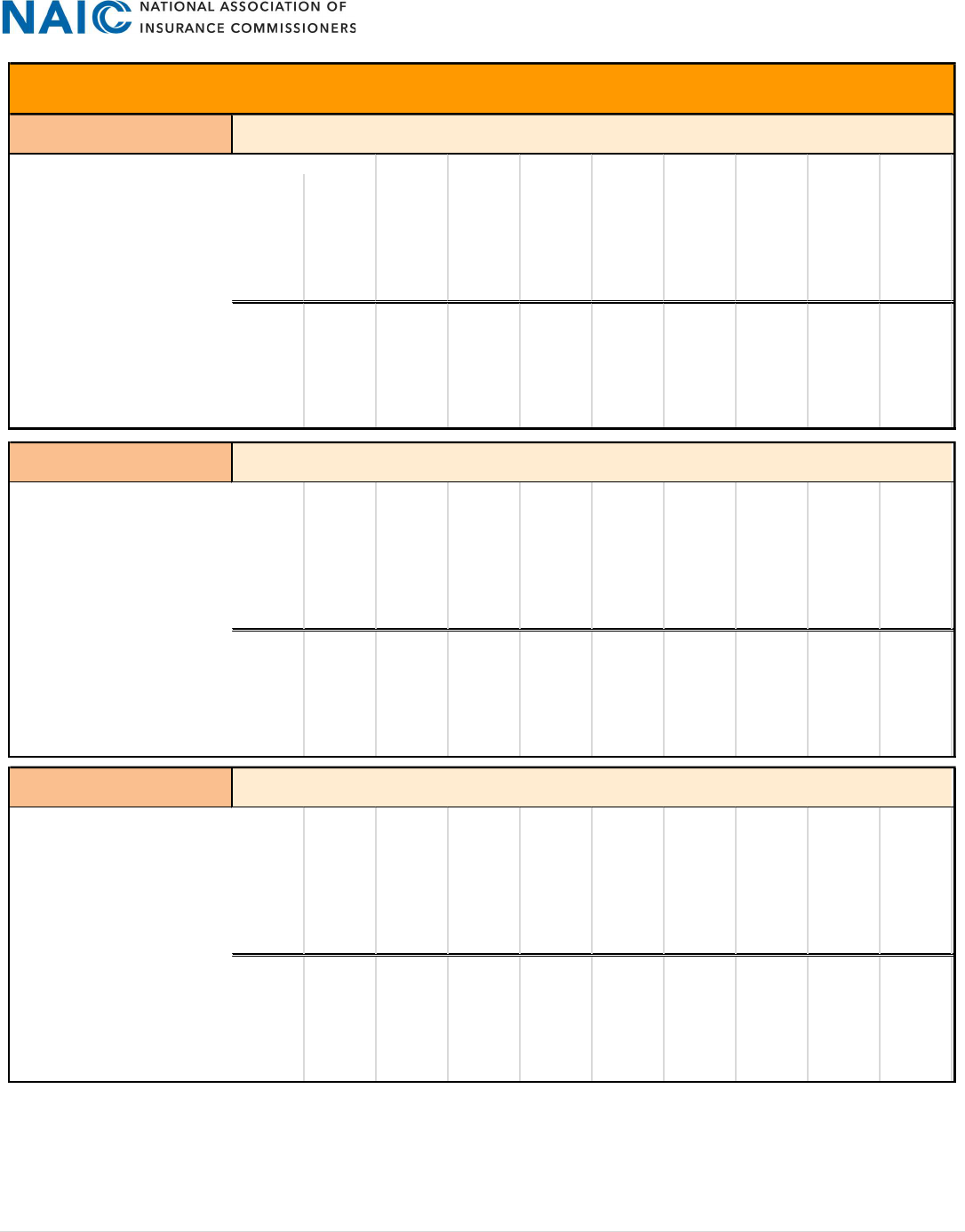

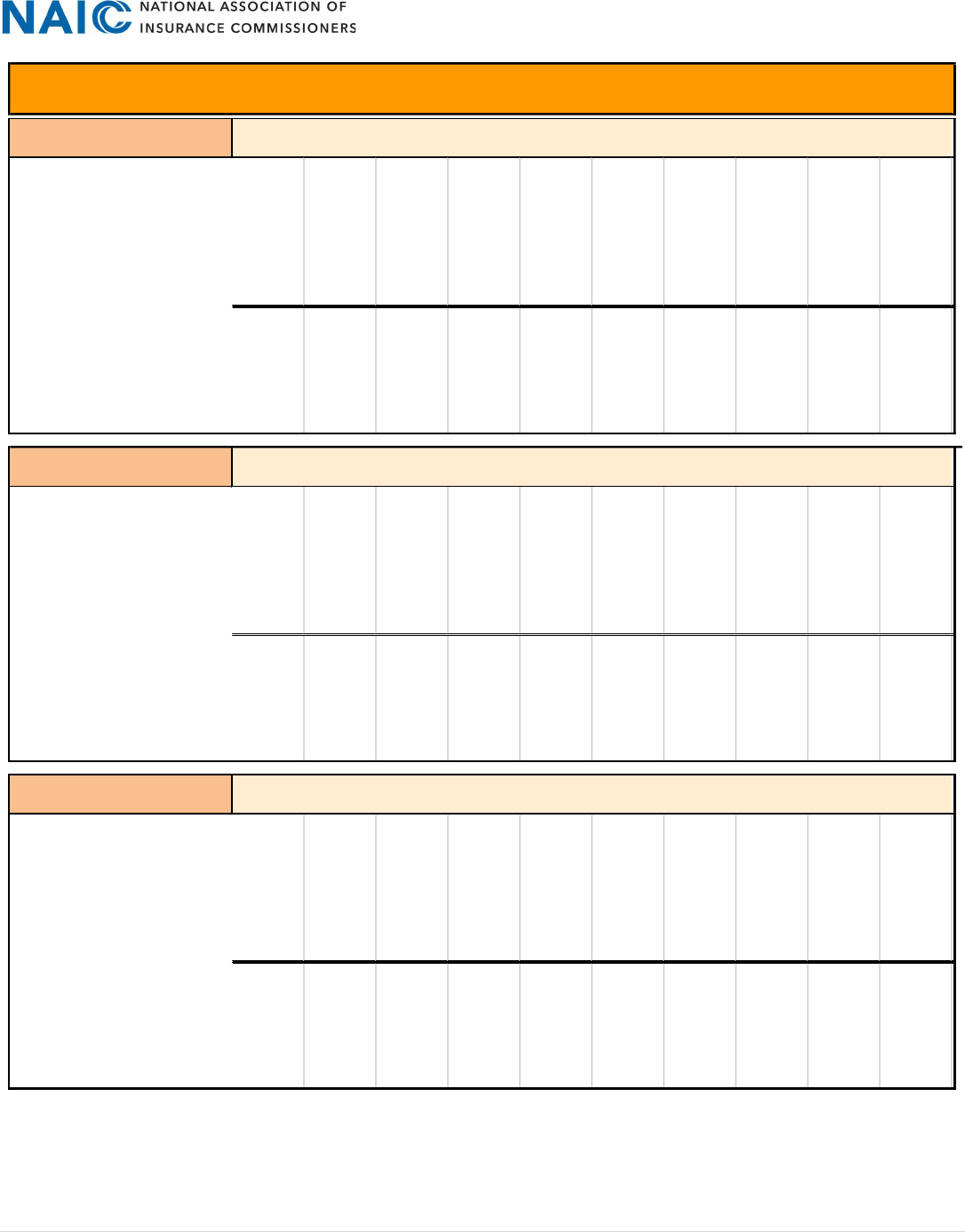

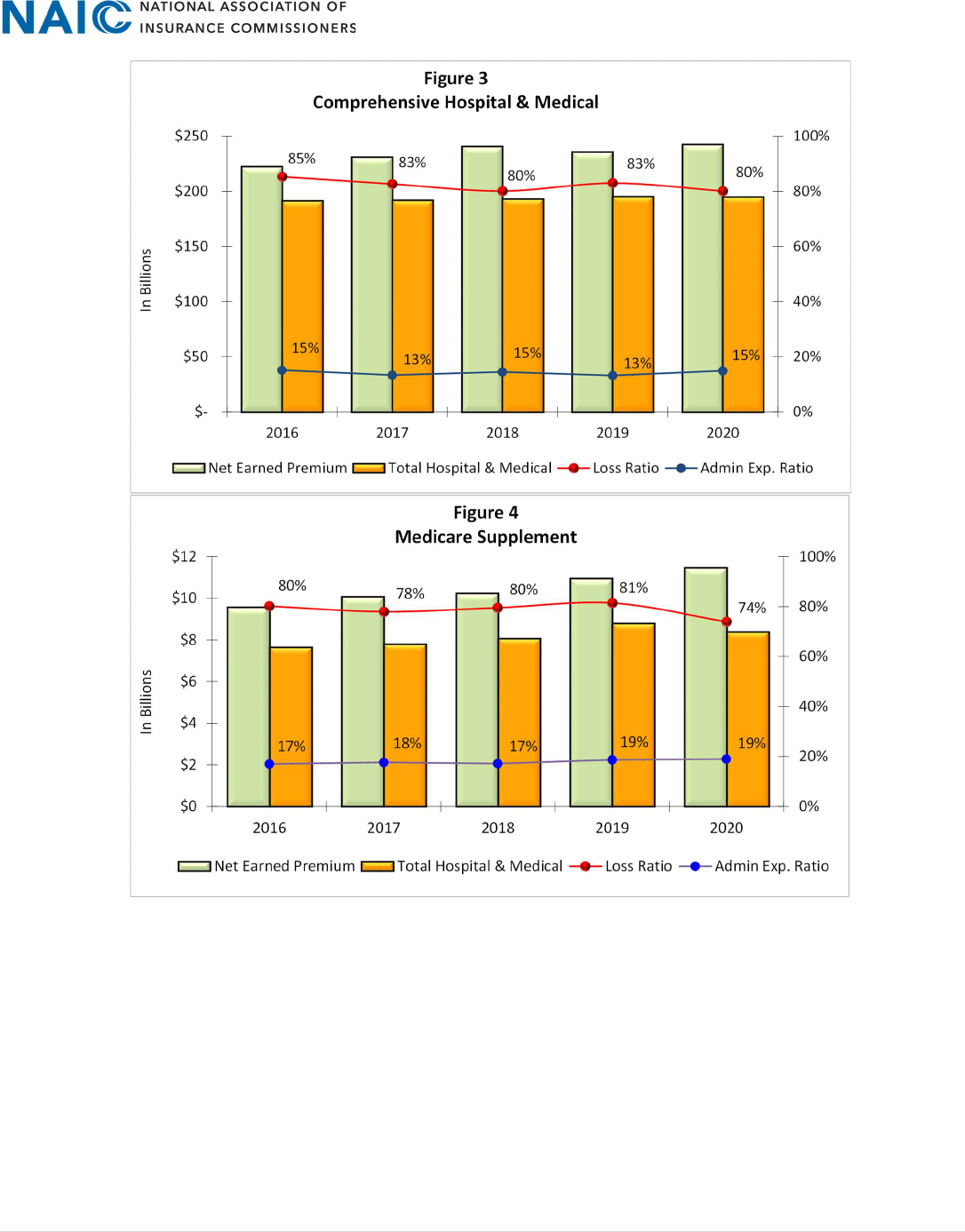

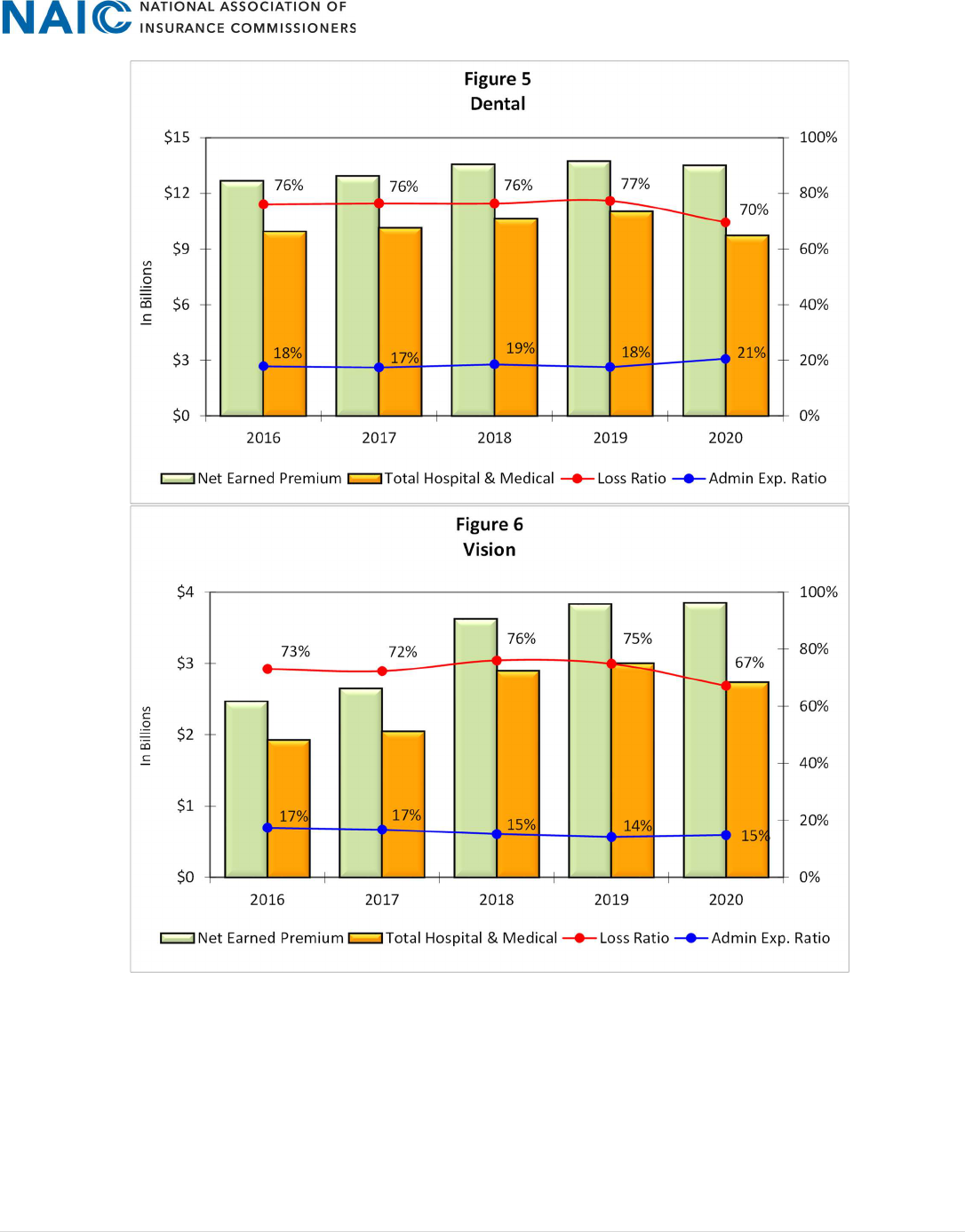

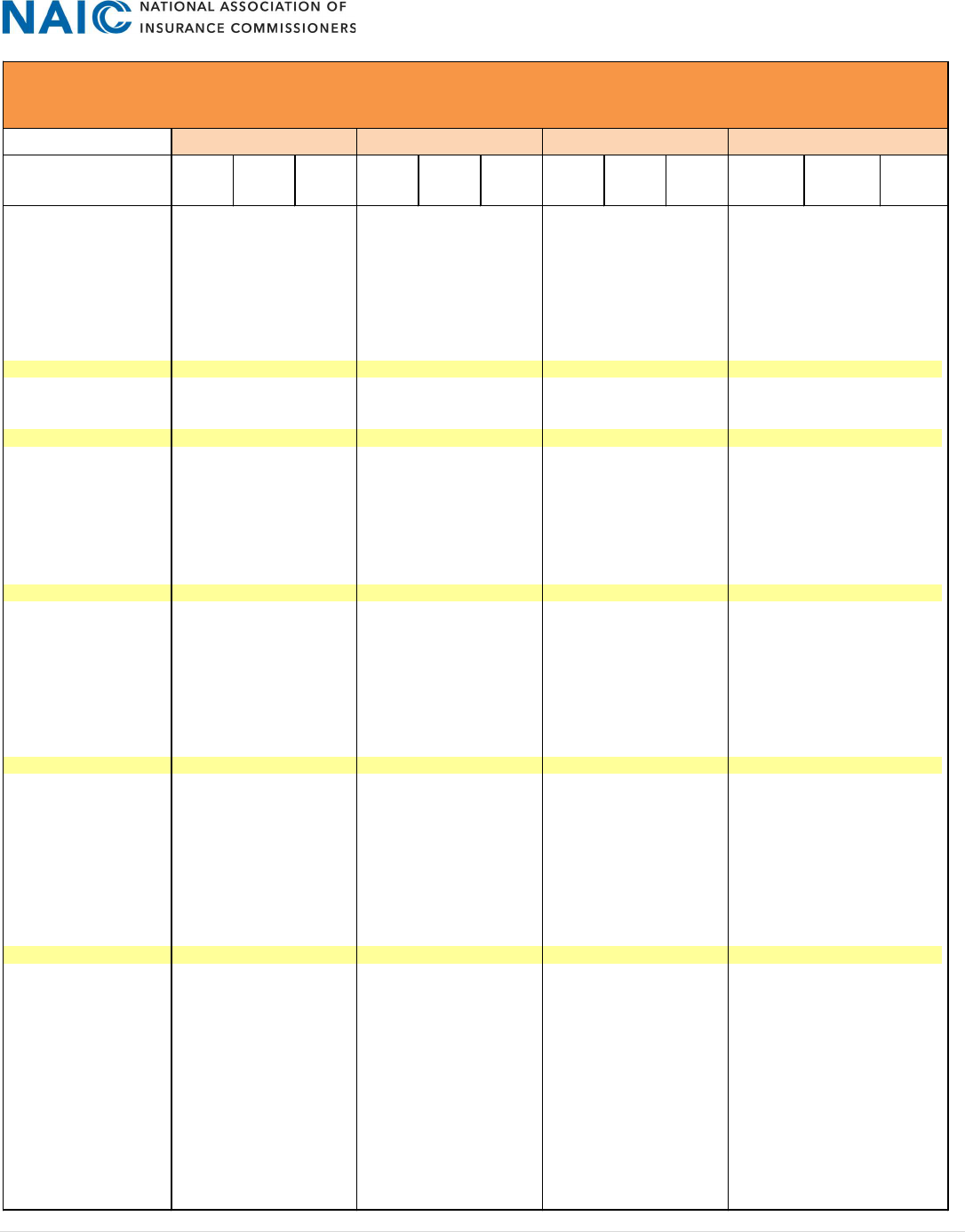

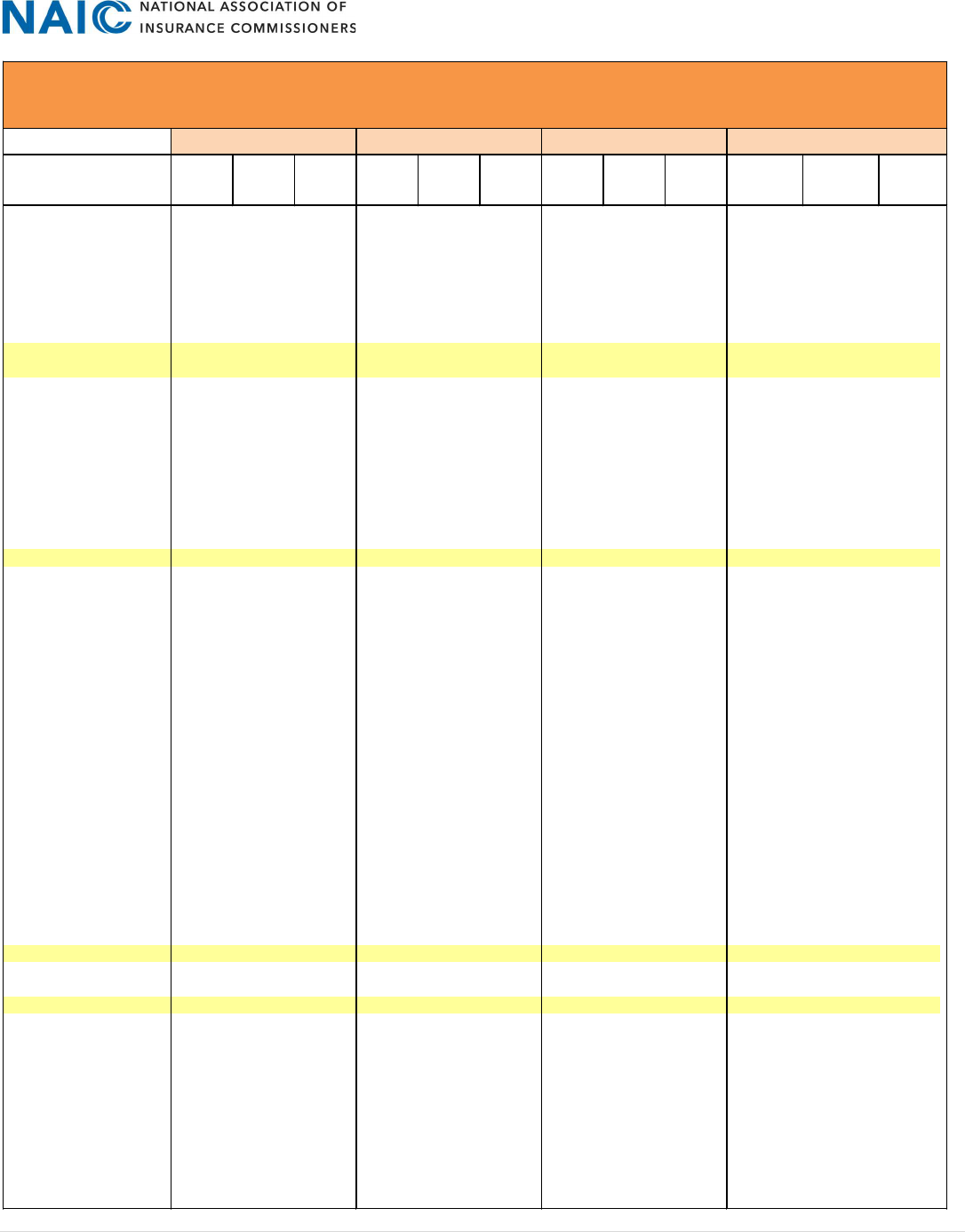

Table 2, starting on the next page, provides an analysis of operations by line of business for 2020. In terms of dollar impact,

the comprehensive hospital and medical ($12 billion), Medicare ($11 billion) and Medicaid ($7 billion) lines of business

were the most profitable. Subsequently, Figures 3 through 10 on pages 6 through 9, illustrate underwriting results, earned

premium, and total hospital and medical expenses in relation to loss ratios by line of business.

Figure 1

Net Income & Profit Margin

U.S. Health Insurance Industry | 2020 Annual Results

3 | P a g e

© 2021 National Association of Insurance Commissioners

Despite the CDC reporng nearly 33 million COVID-19 cases naonwide, as noted above, the health industry reported only

a 7% increase in benefit claims incurred. This is consistent with prior year-over-year changes. However, it is important to

note, that offseng factors appear to have reduced the overall financial impact to insurers such as reduced costs related

to cancelled or delayed medical treatments, procedures, and ulizing other non-emergency health benefits. These

offseng factors are also evident in the decreases in the loss raos by line of business as included in Table 2 below.

However, going forward, there is the potenal that delayed treatments could lead to worsening health condions,

resulng in escalated claims expenses. There is also the potenal that Medicare/Medicare Advantage, and Medicaid

writers as well as comprehensive writers serving older and higher risk populaons could be adversely affected.

Comprehensive

Hospital & Medical

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$242,290

$235,482

$240,595

$230,831

$222,273

$215,385

$207,534

$192,420

$191,446

$191,945

Total Hospital & Medical Exp

$194,772

$195,154

$192,884

$191,717

$191,139

$184,916

$175,179

$163,736

$163,346

$160,206

Claims Adj. Expenses

$7,954

$7,740

$7,797

$7,679

$7,381

$7,413

$7,475

$7,167

$6,990

$6,764

General Admin. Expenses

$28,445

$23,394

$27,217

$23,236

$26,382

$26,833

$25,852

$18,842

$18,131

$18,365

Total Underwriting Deductions

$231,717

$226,283

$227,850

$222,256

$223,898

$219,054

$209,078

$189,712

$188,553

$185,187

Net Underwriting Gain/(Loss)

$12,154

$8,857

$12,972

$9,200

($966)

($2,017)

($70)

$4,023

$4,159

$6,987

Loss Ratio

80.1%

83.0%

80.1%

82.7%

85.3%

85.2%

84.1%

84.5%

84.8%

83.3%

Admin Expense Ratio

14.9%

13.2%

14.5%

13.4%

15.1%

15.8%

15.9%

13.4%

13.0%

13.1%

Combined Ratio

95.0%

96.2%

94.6%

96.0%

100.4%

100.9%

100.0%

97.9%

97.8%

96.4%

Net Premium PMPM

$487

$460

$460

$424

$388

$363

$347

$319

$309

$303

Claims PMPM

$392

$384

$337

$352

$319

$310

$294

$271

$264

$253

Enrollment

41

42

43

44

46

49

49

50

52

53

Medicare Supplement

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$11,455

$10,940

$10,234

$10,072

$9,568

$9,156

$8,690

$8,162

$8,088

$7,811

Total Hospital & Medical Exp

$8,385

$8,789

$8,061

$7,799

$7,640

$7,368

$6,910

$6,457

$6,460

$6,336

Claims Adj. Expenses

$502

$547

$486

$483

$439

$419

$379

$399

$385

$397

General Admin. Expenses

$1,666

$1,500

$1,267

$1,299

$1,193

$1,189

$1,077

$948

$937

$937

Total Underwriting Deductions

$10,616

$10,952

$9,886

$9,637

$9,320

$9,021

$8,157

$7,847

$7,815

$7,608

Net Underwriting Gain/(Loss)

$809

($14)

$342

$444

$271

$119

$564

$304

$258

$195

Loss Ratio

73.9%

81.4%

79.5%

77.9%

80.2%

81.1%

76.9%

79.8%

80.4%

80.4%

Admin Expense Ratio

19.0%

18.7%

17.1%

17.7%

17.0%

17.6%

16.7%

16.5%

16.4%

17.1%

Combined Ratio

92.9%

100.1%

96.7%

95.6%

97.2%

98.7%

93.5%

96.3%

96.8%

97.5%

Net Premium PMPM

$199

$199

$197

$195

$185

$181

$181

$183

$180

$177

Claims PMPM

$147

$162

$157

$152

$148

$147

$139

$146

$145

$142

Enrollment

5

5

4

4

4

4

4

4

4

4

Analysis of Operations by Lines of Business

Table 2

U.S. Health Insurance Industry | 2020 Annual Results

4 | P a g e

© 2021 National Association of Insurance Commissioners

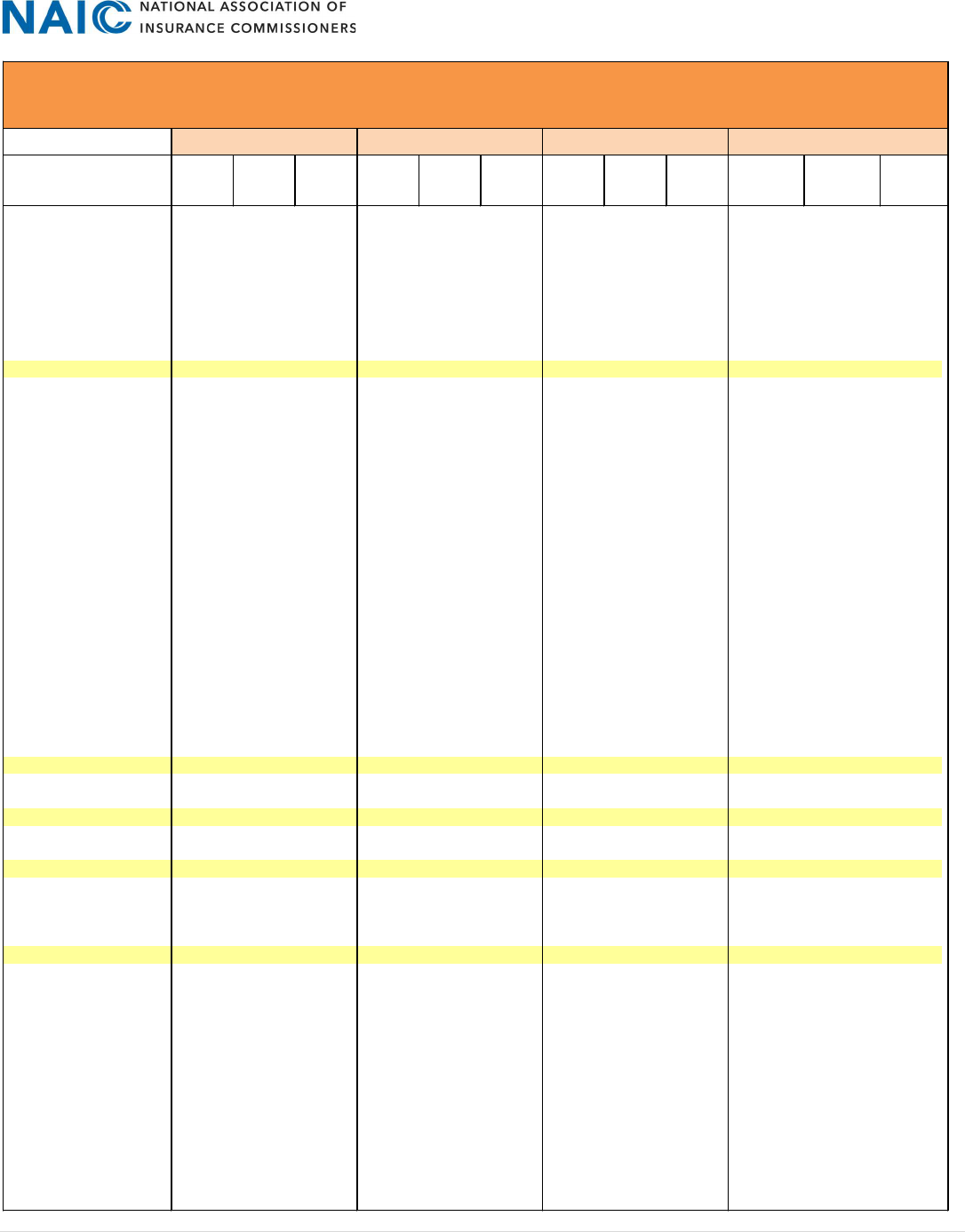

Dental

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$13,511

$13,754

$13,567

$12,941

$12,685

$12,480

$11,752

$10,449

$9,995

$9,327

Total Hospital & Medical Exp

$9,739

$11,035

$10,647

$10,158

$9,955

$9,761

$9,132

$8,059

$7,789

$7,389

Claims Adj. Expenses

$737

$691

$658

$554

$513

$489

$428

$384

$407

$412

General Admin. Expenses

$2,136

$1,821

$1,928

$1,765

$1,829

$1,821

$1,685

$1,282

$1,206

$1,091

Total Underwriting Deductions

$12,606

$13,553

$13,235

$12,477

$12,295

$12,071

$11,241

$9,722

$9,403

$8,895

Net Underwriting Gain/(Loss)

$1,384

$731

$711

$821

$790

$749

$758

$856

$703

$532

Loss Ratio

69.6%

77.3%

76.4%

76.4%

76.1%

76.1%

76.1%

76.2%

77.1%

78.4%

Admin Expense Ratio

20.5%

17.6%

18.5%

17.4%

17.9%

18.0%

17.6%

15.7%

16.0%

15.9%

Combined Ratio

90.1%

94.9%

94.9%

93.8%

94.0%

94.2%

93.7%

91.9%

93.0%

94.4%

Net Premium PMPM

$26

$27

$27

$25

$25

$25

$25

$26

$25

$24

Claims PMPM

$19

$22

$21

$19

$20

$20

$20

$20

$19

$19

Enrollment

42

42

42

44

42

41

40

34

33

32

Vision

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$3,848

$3,831

$3,624

$2,651

$2,469

$2,300

$2,148

$1,694

$1,606

$1,500

Total Hospital & Medical Exp

$2,734

$3,000

$2,893

$2,050

$1,927

$1,832

$1,703

$1,364

$1,312

$1,223

Claims Adj. Expenses

$77

$71

$67

$58

$51

$46

$37

$32

$30

$25

General Admin. Expenses

$527

$497

$511

$415

$405

$388

$369

$234

$220

$211

Total Underwriting Deductions

$3,338

$3,568

$3,471

$2,520

$2,378

$2,272

$2,109

$1,629

$1,559

$1,463

Net Underwriting Gain/(Loss)

$733

$438

$332

$311

$251

$182

$178

$181

$182

$149

Loss Ratio

67.2%

74.9%

76.1%

72.3%

73.1%

74.9%

74.5%

75.3%

75.2%

76.1%

Admin Expense Ratio

14.8%

14.2%

15.2%

16.7%

17.4%

17.7%

17.7%

14.7%

14.4%

14.7%

Combined Ratio

82.0%

89.1%

91.3%

89.0%

90.5%

92.6%

92.2%

90.0%

89.5%

90.8%

Net Premium PMPM

$9

$9

$9

$7

$7

$6

$6

$6

$6

$5

Claims PMPM

$6

$7

$7

$5

$5

$5

$5

$5

$4

$4

Enrollment

36

36

35

33

31

30

29

25

25

23

FEHBP

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$40,456

$38,744

$37,529

$37,796

$37,868

$36,313

$34,138

$32,058

$31,601

$31,266

Total Hospital & Medical Exp

$36,123

$36,669

$35,246

$34,643

$34,005

$33,031

$31,622

$30,234

$29,578

$28,398

Claims Adj. Expenses

$999

$911

$972

$870

$854

$809

$782

$782

$704

$695

General Admin. Expenses

$2,168

$1,485

$1,955

$1,355

$2,013

$2,025

$1,835

$1,112

$1,078

$1,042

Total Underwriting Deductions

$39,291

$39,064

$38,172

$36,866

$36,854

$35,859

$34,251

$32,132

$31,358

$30,138

Net Underwriting Gain/(Loss)

$563

$108

$293

$158

$541

$413

$376

$247

$252

$252

Loss Ratio

90.6%

93.6%

91.6%

93.6%

90.9%

91.0%

91.4%

93.4%

93.6%

93.5%

Admin Expense Ratio

7.9%

6.1%

7.6%

6.0%

7.7%

7.8%

7.6%

5.9%

5.6%

5.7%

Combined Ratio

98.6%

99.7%

99.2%

99.6%

98.6%

98.9%

98.9%

99.2%

99.2%

99.2%

Net Premium PMPM

$369

$371

$415

$399

$409

$406

$403

$369

$357

$356

Claims PMPM

$335

$348

$381

$374

$373

$370

$369

$346

$334

$333

Enrollment

9

9

8

8

8

7

7

7

7

7

Table 2

Analysis of Operations by Lines of Business

U.S. Health Insurance Industry | 2020 Annual Results

5 | P a g e

© 2021 National Association of Insurance Commissioners

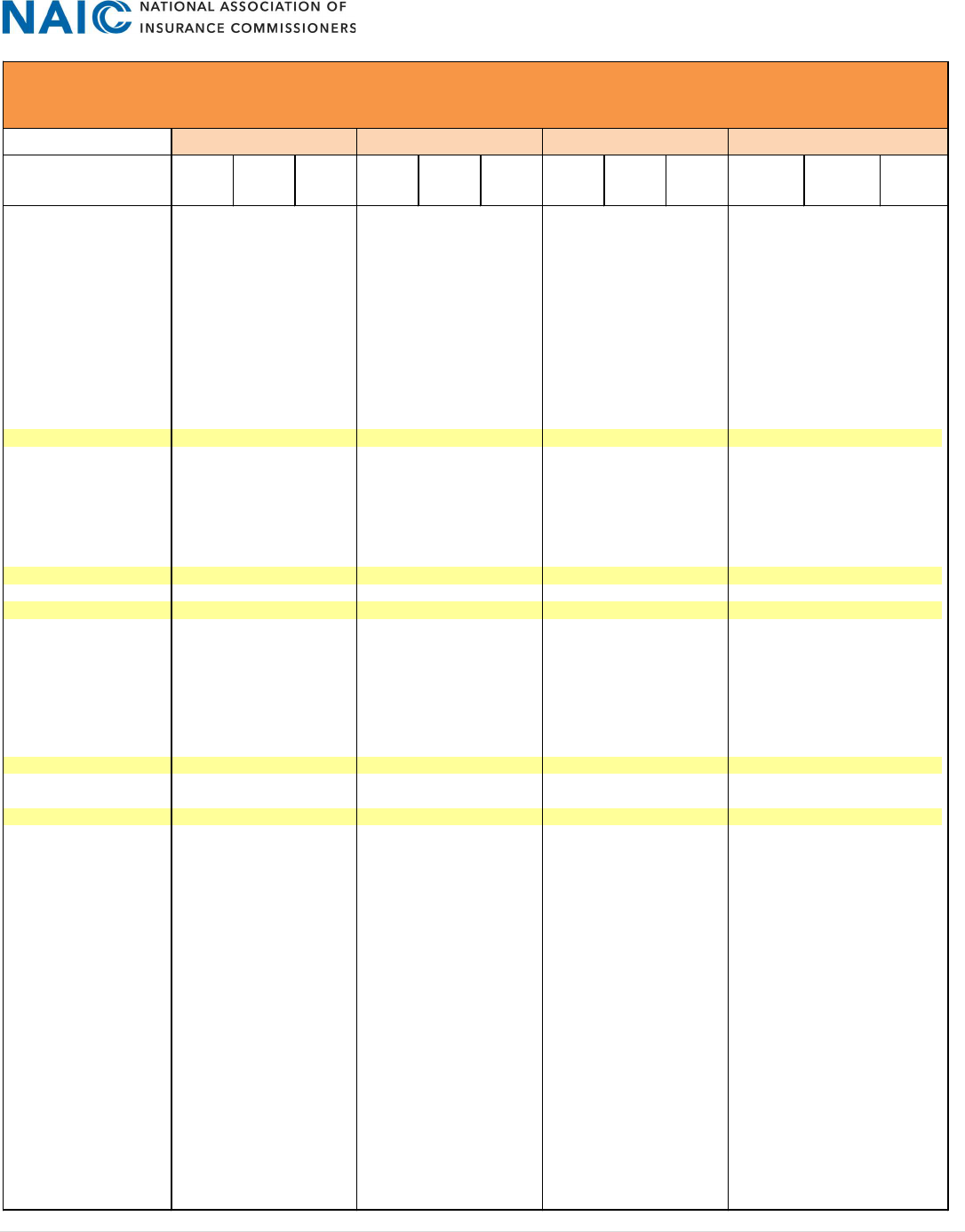

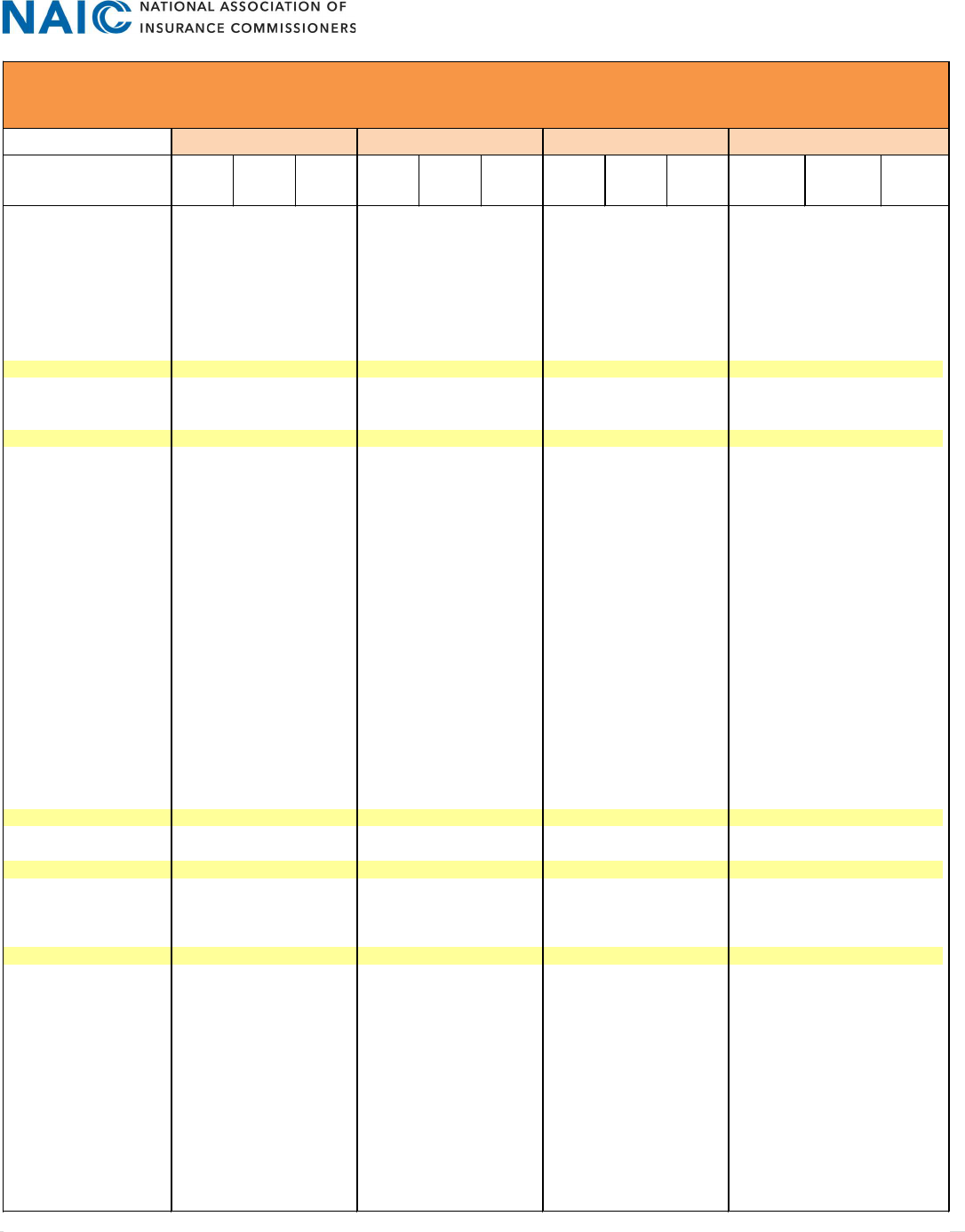

Table 2

Analysis of Operations by Lines of Business

Medicare

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$249,351

$209,661

$192,548

$171,532

$159,507

$146,804

$131,029

$105,568

$97,810

$90,958

Total Hospital & Medical Exp

$205,418

$179,337

$164,541

$146,837

$135,243

$127,385

$113,800

$91,644

$84,119

$77,532

Claims Adj. Expenses

$8,337

$7,432

$6,424

$5,831

$5,118

$4,766

$4,071

$3,184

$2,705

$2,282

General Admin. Expenses

$23,341

$16,042

$17,597

$13,493

$14,456

$13,144

$11,684

$8,399

$7,696

$7,096

Total Underwriting Deductions

$237,276

$203,124

$188,474

$166,258

$154,519

$145,377

$129,762

$103,325

$94,594

$86,952

Net Underwriting Gain/(Loss)

$11,377

$6,818

$4,435

$5,225

$4,929

$1,219

$1,448

$2,339

$4,424

$4,083

Loss Ratio

82.7%

85.6%

85.2%

85.7%

84.6%

87.0%

86.9%

86.8%

85.0%

85.2%

Admin Expense Ratio

12.7%

11.2%

12.5%

11.3%

12.3%

12.2%

12.0%

11.0%

10.5%

10.3%

Combined Ratio

95.4%

96.8%

97.7%

97.0%

96.9%

99.2%

98.9%

97.8%

95.5%

95.5%

Net Premium PMPM

$1,083

$990

$970

$939

$923

$891

$901

$909

$919

$941

Claims PMPM

$897

$848

$828

$805

$781

$775

$783

$789

$791

$802

Enrollment

25

18

17

15

15

14

12

10

9

8

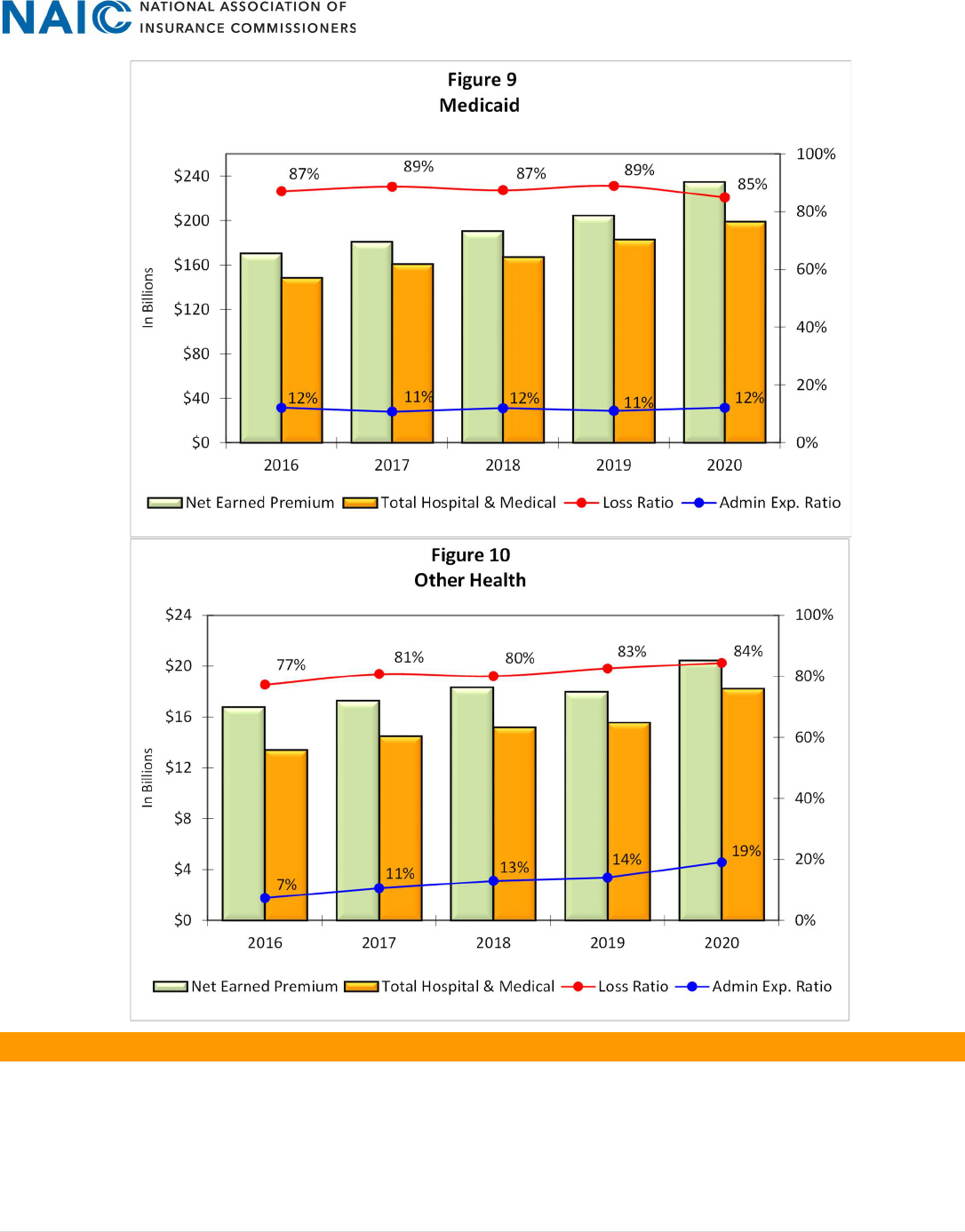

Medicaid

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$234,853

$204,595

$190,505

$180,994

$170,461

$148,609

$115,661

$88,067

$77,730

$65,653

Total Hospital & Medical Exp

$199,032

$182,883

$167,308

$160,899

$148,585

$127,938

$98,905

$77,470

$68,810

$56,259

Claims Adj. Expenses

$6,373

$6,103

$5,751

$5,388

$5,134

$4,872

$3,637

$2,957

$2,283

$1,900

General Admin. Expenses

$22,086

$16,497

$17,218

$14,112

$15,520

$13,073

$10,322

$7,168

$6,622

$6,040

Total Underwriting Deductions

$227,342

$205,305

$190,142

$180,540

$169,393

$145,857

$113,074

$87,606

$77,836

$64,225

Net Underwriting Gain/(Loss)

$6,770

$138

$1,066

$1,033

$1,405

$3,635

$2,235

$1,106

$480

$1,650

Loss Ratio

85.0%

88.9%

87.4%

88.7%

87.1%

85.6%

86.0%

87.3%

88.0%

85.4%

Admin Expense Ratio

12.2%

11.0%

12.0%

10.7%

12.1%

12.0%

12.1%

11.4%

11.4%

12.1%

Combined Ratio

97.1%

99.9%

99.4%

99.4%

99.2%

97.6%

98.1%

98.8%

99.4%

97.5%

Net Premium PMPM

$461

$389

$368

$387

$360

$339

$317

$292

$266

$253

Claims PMPM

$394

$348

$323

$344

$315

$291

$274

$257

$236

$217

Enrollment

46

43

43

39

40

38

35

26

25

23

Other Health

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

(In Millions, Except PMPM)

Net Earned Premium

$20,434

$17,977

$18,328

$17,271

$16,773

$16,269

$15,792

$12,145

$13,181

$10,701

Total Hospital & Medical Exp

$18,222

$15,545

$15,171

$14,473

$13,392

$13,275

$13,569

$10,232

$10,549

$8,711

Claims Adj. Expenses

$822

$782

$391

$645

$438

$772

$1,045

$790

$778

$793

General Admin. Expenses

$3,374

$1,868

$2,060

$1,245

$844

$618

$758

$886

$972

$546

Total Underwriting Deductions

$22,763

$18,218

$17,581

$16,378

$14,717

$14,600

$15,400

$11,912

$12,301

$10,060

Net Underwriting Gain/(Loss)

($748)

$640

$1,319

$1,576

$2,666

$2,128

$944

$632

$1,155

$956

Loss Ratio

84.3%

82.6%

80.1%

80.7%

77.3%

79.0%

83.2%

81.6%

78.4%

79.2%

Admin Expense Ratio

19.1%

14.1%

13.0%

10.5%

7.4%

8.3%

11.0%

13.4%

13.0%

12.2%

Combined Ratio

103.4%

96.6%

93.0%

91.2%

84.7%

87.3%

94.2%

95.0%

91.4%

91.3%

Net Premium PMPM

$46

$42

$45

$44

$44

$47

$49

$44

$49

$48

Claims PMPM

$42

$36

$37

$37

$35

$38

$42

$38

$40

$39

Enrollment

37

36

34

33

32

29

28

23

22

19

U.S. Health Insurance Industry | 2020 Annual Results

6 | P a g e

© 2021 National Association of Insurance Commissioners

U.S. Health Insurance Industry | 2020 Annual Results

7 | P a g e

© 2021 National Association of Insurance Commissioners

U.S. Health Insurance Industry | 2020 Annual Results

8 | P a g e

© 2021 National Association of Insurance Commissioners

U.S. Health Insurance Industry | 2020 Annual Results

9 | P a g e

© 2021 National Association of Insurance Commissioners

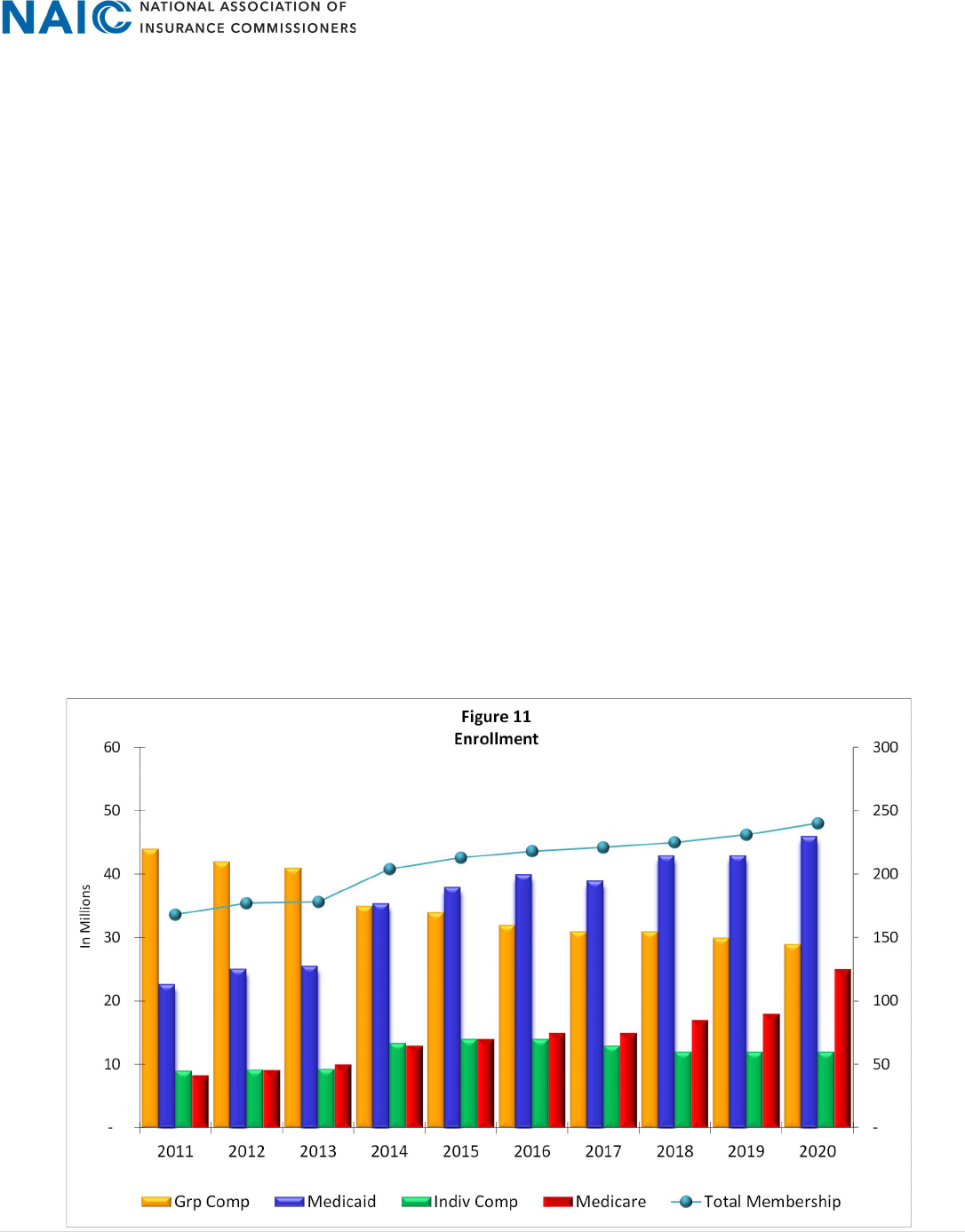

ENROLLMENT AND PREMIUM REVENUES

Enrollment increased 4% (9 million) to 240 million. The enrollment increase is reflected in a 37% (6.6 million) increase in

Medicare, a 4.8% (2.1 million) increase in the Medicaid line of business, and a 3.1% (1.1 million) increase in Medicare Part

D Prescription Drug coverage. However, the industry also reported a 4.3% (1.3 million) decrease in the group

comprehensive line of business. Figure 11 illustrates the enrollment trend for the four largest revenue generating lines of

business for the past 10 years. Despite the COVID-19 pandemic, the industry still experienced growth in Medicaid and

Medicare. Increased unemployment rates caused by the pandemic have also disrupted health coverage for millions of

people as most working-age adults receive health insurance coverage for themselves and their families through their

U.S. Health Insurance Industry | 2020 Annual Results

10 | P a g e

© 2021 National Association of Insurance Commissioners

employer. However, many of those who lost job-based health insurance coverage would possibly qualify for Medicaid or

had the opportunity to purchase individual health coverage through the exchange or other managed care health providers.

The shi in business concentration can also be attributed to an increase in the number of insureds becoming eligible for

either Medicare or Medicaid as evidenced by increases in enrollment in these lines. A certain amount of the Medicaid

enrollment increase is likely due to the continued expansion of Medicaid programs in certain states.

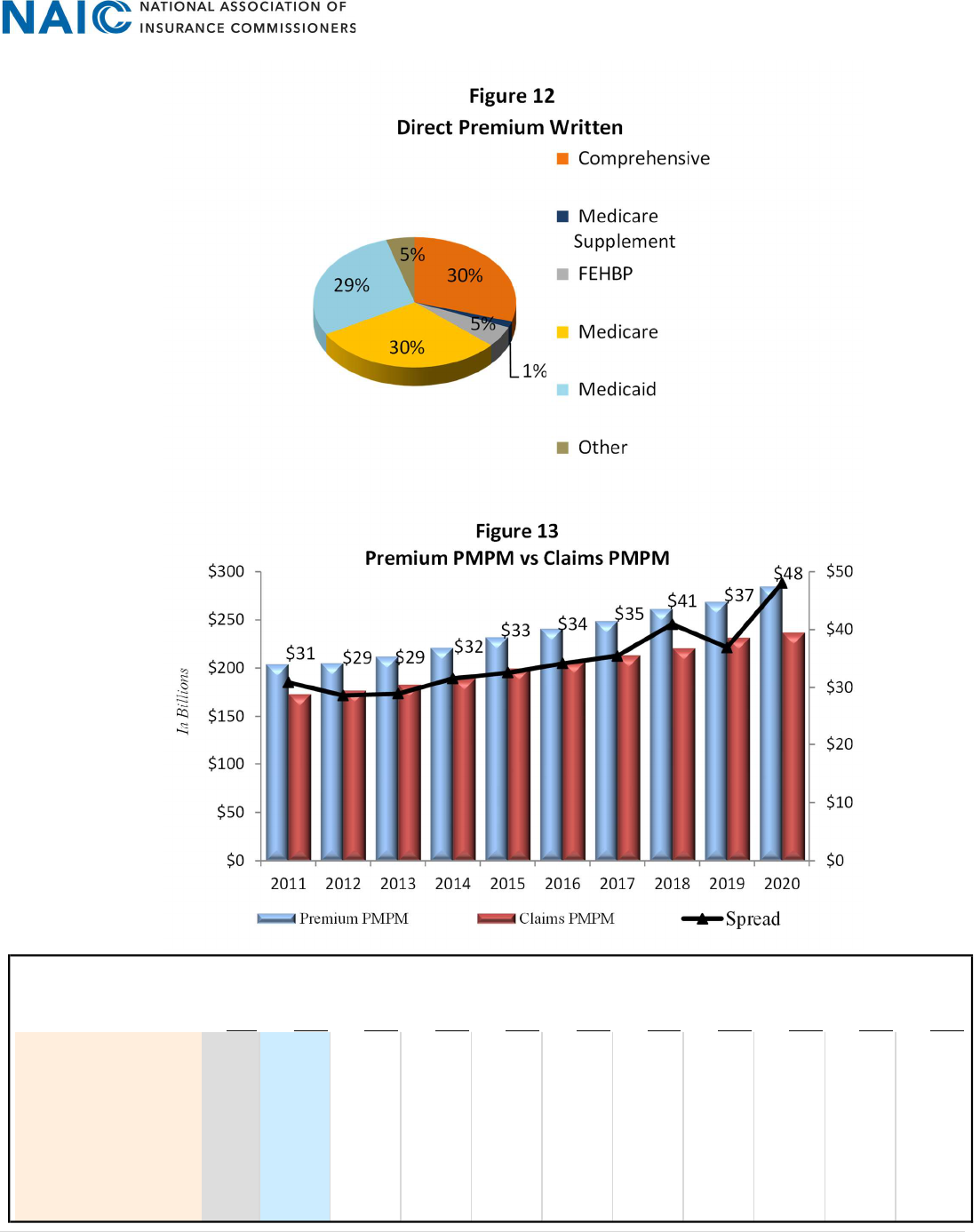

Direct written premium increased 8.3% ($63 billion) to $824.7 billion. Figure 12 illustrates the mix of direct written

premium for 2020. During the last several years, there has been a gradual shift in the allocation of premium between the

lines of business. In comparison to 2019, direct comprehensive medical decreased to 29.8% of total premium from 31.7%,

while Medicare increased to 30.4% from 28.6% and Medicaid increased modestly to 28.6% from 27.7%.

Health entities reported premium per member per month (PMPM) of $284 and claims PMPM of $236 for 2020. Figure 13

illustrates a 10-year trend on an aggregate basis of the increase in premium PMPM vs claims PMPM and the resulting

spread. In referring back to Table 2, it is apparent the Medicare line of business is the most expensive at over $1 thousand

per member month but also reported one of the highest net underwriting gains with a spread of premium PMPM over

claims PMPM of $186 and an aggregate underwriting gain of $11 billion.

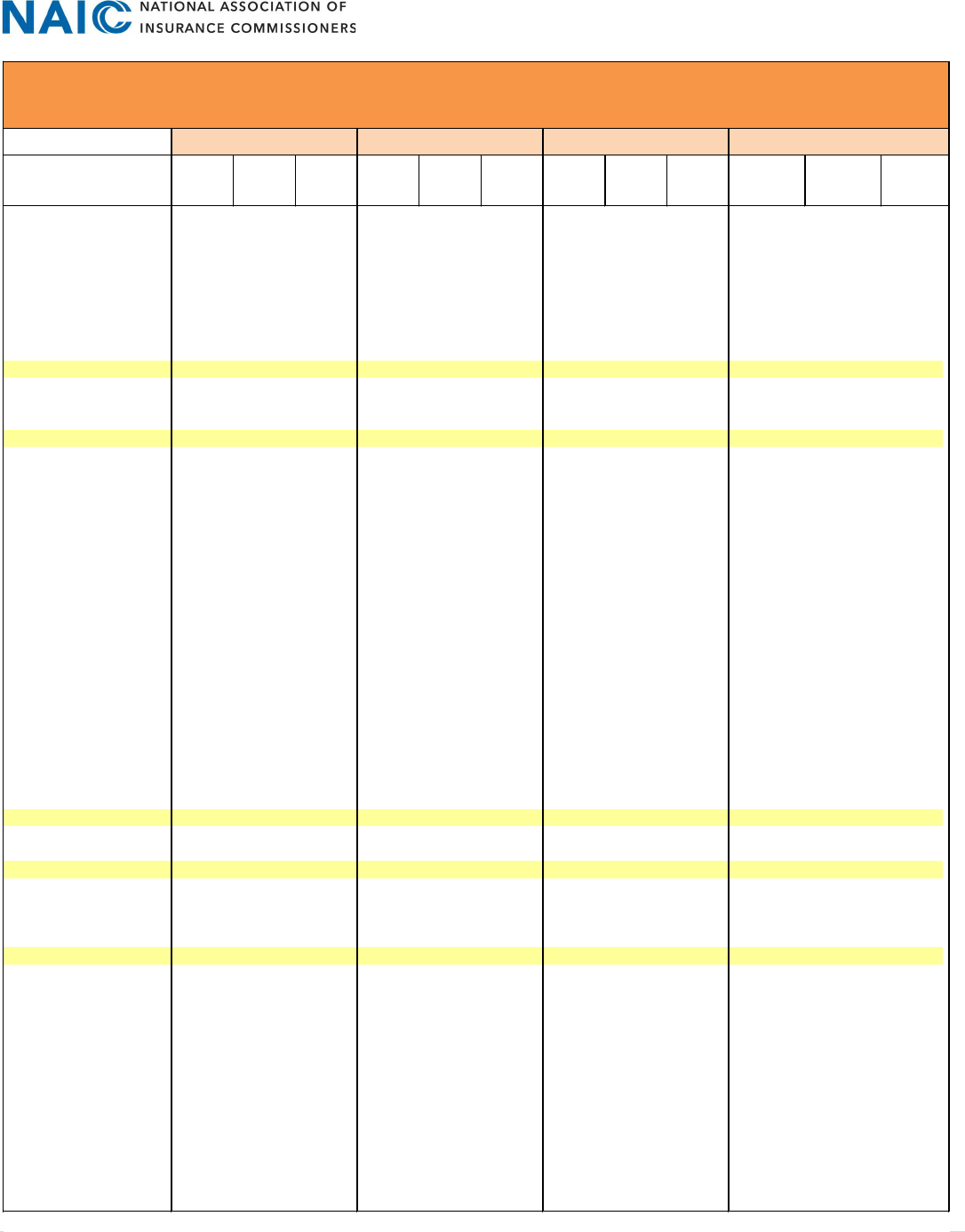

Table 3 on page 11, provides direct written premium by line of business for the last 10 years. The largest increases in

written premium from 2019 are most evident in a 13% ($29 billion) increase in Medicare, a 12% ($26 billion) increase in

Medicaid, an 8% ($6 billion) increase in the individual comprehensive line of business, and a 3% ($1 billion) increase in

Federal Employee Health Benefit Plan. The overall premium growth can be attributed to increases in enrollment, and

premium rates. In a 10-year comparison to 2011, the most significant increases in written premium are in the Medicaid

($168 billion), Medicare ($157 billion), individual comprehensive ($56 billion), Federal Employee Health Benefit Plan,

Dental ($4 billion), Medicare Supplement ($4 billion), and Medicare Part D ($10 billion) lines of business. The group

comprehensive Line of business decreased ($10 billion). Table 4 on pages 13-21 provides a further breakout of written

premium, claims, loss ratio, and enrollment by state and by line of business. The states high-lighted in yellow are the five

largest writers in that particular line of business.

U.S. Health Insurance Industry | 2020 Annual Results

11 | P a g e

© 2021 National Association of Insurance Commissioners

(In Millions)

Chg. 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011

Individual Comprehensive

7.6%

$78,232

$72,722

$76,017

$68,660

$63,310

$55,292

$43,388

$24,713

$23,389

$22,624

Group Comprehensive

(0.5)%

$165,839

$166,717

$165,339

$162,605

$160,574

$162,297

$166,375

$172,220

$174,959

$175,843

Medicare Supplement

4.3%

$12,041

$11,546

$10,807

$10,596

$10,061

$9,609

$9,105

$8,531

$8,439

$8,138

Vision

(1.3)%

$2,619

$2,654

$2,561

$2,410

$2,255

$2,099

$1,952

$1,635

$1,550

$1,448

Dental

(3.3)%

$13,579

$14,048

$13,855

$14,090

$13,074

$12,561

$12,017

$10,046

$10,113

$9,587

FEHBP

3.4%

$42,639

$41,218

$38,942

$37,860

$37,923

$36,356

$34,140

$32,061

$31,669

$31,209

Medicare

13.3%

$248,793

$219,554

$192,253

$170,413

$158,908

$147,273

$128,890

$105,917

$99,981

$91,519

Medicaid

12.3%

$234,421

$208,695

$192,181

$180,535

$170,234

$149,148

$115,977

$89,069

$78,535

$65,994

Other Health

4.8%

$21,144

$20,170

$18,883

$18,142

$18,569

$17,349

$16,900

$14,111

$14,194

$11,373

Table 3

Direct Written Premium by Lines of Business

U.S. Health Insurance Industry | 2020 Annual Results

12 | P a g e

© 2021 National Association of Insurance Commissioners

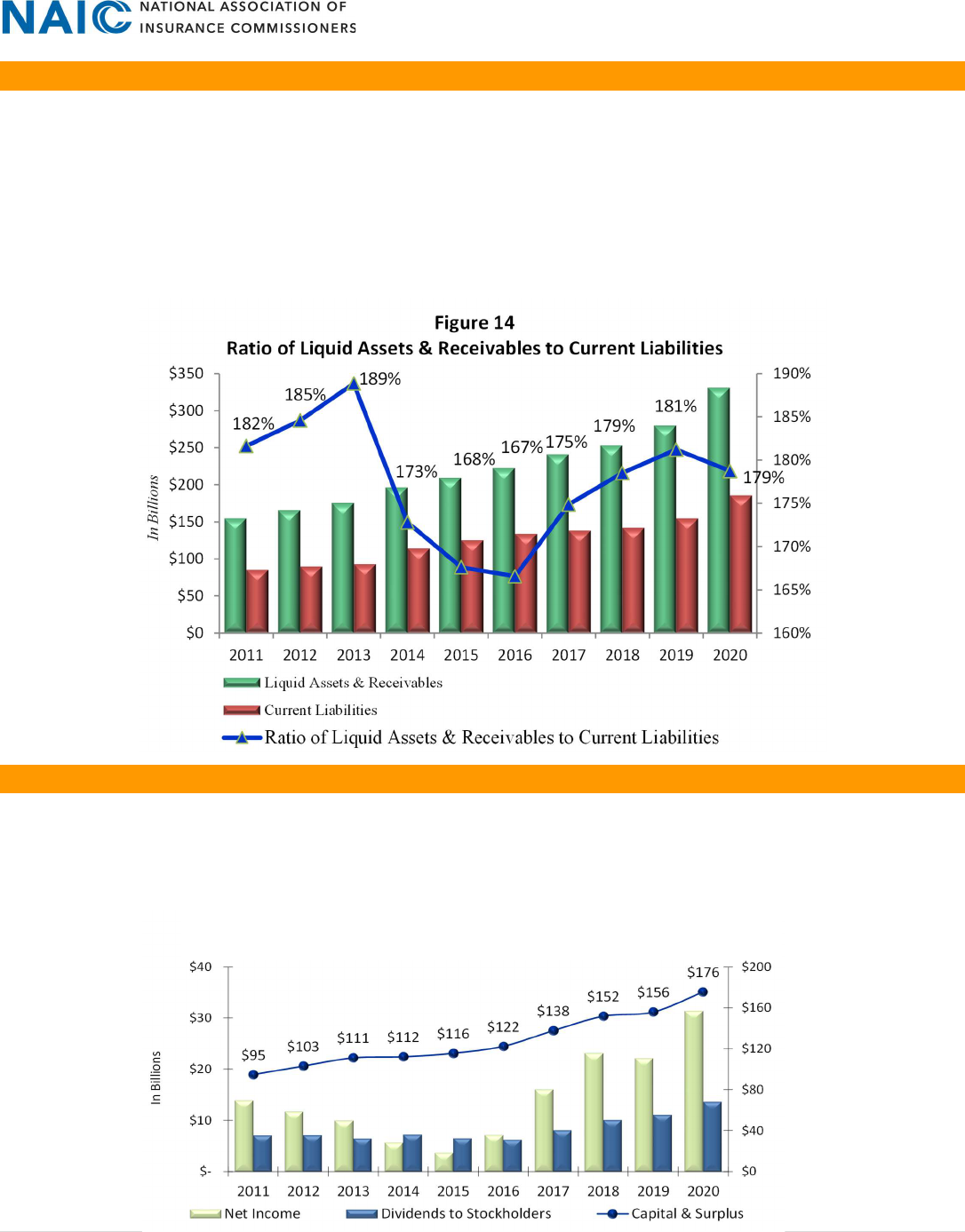

CASH FLOW AND LIQUIDITY

The health insurance industry showed a significant increase in operating cash flow to $55.3 billion in 2020 as compared to

operating cash flow of $24.7 billion in 2019. The considerable increase in positive cash flow is due primarily to a 9.6% ($72

billion) increase in premiums collected. However, this was partially offset by a 4% ($22.4 billion) increase in benefits and

loss-related payments and a 16.7% ($15 billion) decrease in commissions and expenses paid.

As illustrated in Figure 14, liquid assets and receivables increased 18% ($52 billion) to $332 billion in 2020 from $280 billion

in the prior year end. This was partially offset by a 20% ($31 billion) increase in current liabilities to $185 billion from $155

billion. This resulted in an unfavorable decrease in the ratio of liquid assets and receivables to current liabilities to 179%

from 181%.

CAPITAL AND SURPLUS

Health entities reported a 12.6% ($20 billion) increase in capital and surplus to $176 billion from $156 billion at Dec. 31,

2019 as illustrated in Figure 15. The increase is due primarily to net income of $31 billion, a $3 billion increase in unrealized

capital gains, and paid-in surplus of $3.4 billion. These items were partially offset by dividends of $14 billion paid to

stockholders, and a $1.7 billion increase in non-admitted assets.

Figure 15

Capital & Surplus, Net Income & Dividends Paid

U.S. Health Insurance Industry | 2020 Annual Results

13 | P a g e

© 2021 National Association of Insurance Commissioners

($ in Millions except Enrollment)

State 2020 2019 % Chg. 2020 2019 % Chg. 2020 2019

%

Pt Chg.

2020 2019 % Chg.

Alabama

$1,527

$1,368

11.7%

$1,194

$1,103

8.3%

78.2%

80.8%

(2.6)

179,380

170,702

5.1%

Alaska

$160

$156

2.6%

$182

$162

12.0%

106.5%

109.7%

(3.2)

17,098

16,781

1.9%

Arizona

$1,205

$1,111

8.4%

$839

$785

6.9%

69.5%

72.6%

(3.1)

161,951

163,322

(0.8)%

Arkansas

$1,650

$1,433

15.1%

$1,185

$1,152

2.9%

71.8%

80.4%

(8.5)

358,932

312,876

14.7%

California

$280

$398

(29.5)%

$204

$337

(39.4)%

72.8%

84.7%

(11.9)

45,224

69,598

(35.0)%

Colorado

$1,321

$1,351

(2.2)%

$938

$1,057

(11.3)%

71.2%

78.5%

(7.3)

210,731

191,361

10.1%

Connecticut

$958

$867

10.4%

$740

$702

5.5%

77.3%

80.9%

(3.6)

108,177

105,731

2.3%

Delaware

$251

$228

10.0%

$168

$140

19.6%

69.6%

64.1%

5.5

25,069

22,483

11.5%

District of Columbia

$200

$169

18.3%

$185

$168

9.8%

92.4%

99.6%

(7.2)

35,812

30,094

19.0%

Florida

$12,303

$11,554

6.5%

$9,453

$8,333

13.4%

76.6%

73.5%

3.1

1,973,244

1,895,280

4.1%

Georgia

$3,194

$2,906

9.9%

$2,483

$2,256

10.1%

84.3%

77.7%

6.7

544,215

432,970

25.7%

Hawaii

$313

$232

34.9%

$198

$199

(0.5)%

63.3%

85.8%

(22.5)

36,310

33,944

7.0%

Idaho

$777

$665

16.9%

$444

$551

(19.4)%

59.7%

82.9%

(23.2)

93,668

112,353

(16.6)%

Illinois

$2,435

$2,638

(7.7)%

$2,181

$2,040

0.0%

82.7%

84.6%

(1.8)

351,189

355,669

(1.3)%

Indiana

$609

$544

12.0%

$468

$448

4.5%

76.9%

82.4%

(5.5)

120,256

121,527

(1.0)%

Iowa

$695

$711

(2.3)%

$507

$513

(1.1)%

72.3%

75.4%

(3.2)

113,527

108,154

5.0%

Kansas

$448

$360

24.5%

$265

$259

2.4%

59.2%

72.0%

(12.8)

82,266

75,437

9.1%

Kentucky

$666

$687

(3.0)%

$502

$526

(4.6)%

75.6%

76.6%

(1.0)

105,355

107,519

(2.0)%

Louisiana

$1,032

$878

17.5%

$724

$759

(4.6)%

70.4%

86.6%

(16.3)

134,213

134,342

(0.1)%

Maine

$438

$529

(17.3)%

$341

$385

(11.3)%

80.4%

74.1%

6.3

58,508

61,081

(4.2)%

Maryland

$1,382

$1,358

1.7%

$1,366

$1,233

10.8%

97.0%

93.1%

3.9

262,548

234,844

11.8%

Massachusetts

$2,531

$2,466

2.7%

$2,354

$2,283

3.1%

92.1%

93.7%

(1.5)

386,776

433,287

(10.7)%

Michigan

$1,813

$1,863

(2.7)%

$1,349

$1,381

(2.3)%

74.0%

74.1%

(0.1)

315,166

306,088

3.0%

Minnesota

$1,085

$766

41.6%

$686

$700

(1.9)%

63.1%

91.7%

(28.6)

153,127

145,078

5.5%

Mississippi

$936

$810

15.5%

$707

$638

10.9%

76.8%

78.7%

(1.9)

163,886

151,674

8.1%

Missouri

$961

$828

16.1%

$673

$642

4.8%

69.9%

77.5%

(7.6)

185,608

162,971

13.9%

Montana

$335

$385

(12.8)%

$291

$296

(1.5)%

82.9%

82.8%

0.1

48,277

46,776

3.2%

Nebraska

$848

$918

(7.7)%

$642

$661

(3.0)%

75.7%

72.0%

3.7

83,928

90,048

(6.8)%

Nevada

$564

$595

(5.3)%

$445

$439

1.2%

78.9%

73.7%

5.1

115,084

108,974

5.6%

New Hampshire

$268

$264

1.3%

$179

$190

(5.7)%

67.9%

72.6%

(4.7)

49,094

46,130

6.4%

New Jersey

$2,078

$1,892

9.8%

$1,856

$1,780

4.3%

89.5%

95.8%

(6.3)

331,277

319,799

3.6%

New Mexico

$202

$286

(29.4)%

$148

$238

(38.1)%

75.9%

84.1%

(8.3)

33,610

48,220

(30.3)%

New York

$1,667

$1,911

(12.8)%

$1,400

$1,676

(16.4)%

82.2%

87.7%

(5.5)

307,688

343,866

(10.5)%

North Carolina

$4,273

$4,196

1.9%

$3,375

$3,264

3.4%

79.0%

77.8%

1.2

507,348

477,578

6.2%

North Dakota

$229

$262

(12.7)%

$201

$228

(11.9)%

87.7%

86.8%

0.8

40,695

43,027

(5.4)%

Ohio

$1,471

$1,525

(3.6)%

$1,194

$1,195

(0.0)%

81.2%

78.3%

2.9

225,941

227,947

(0.9)%

Oklahoma

$1,099

$1,181

(7.0)%

$1,027

$859

19.5%

88.0%

77.4%

10.6

158,516

151,521

4.6%

Oregon

$1,297

$1,155

12.3%

$1,016

$1,046

(2.8)%

78.5%

90.5%

(12.1)

168,529

165,561

1.8%

Pennsylvania

$3,848

$3,470

10.9%

$2,461

$2,612

0.0%

63.7%

77.5%

(13.7)

568,630

593,963

(4.3)%

Rhode Island

$237

$247

(4.1)%

$184

$193

(4.8)%

77.7%

78.3%

(0.6)

41,208

41,726

(1.2)%

South Carolina

$1,670

$1,704

(2.0)%

$1,257

$1,165

7.9%

74.9%

70.0%

4.9

243,464

225,296

8.1%

South Dakota

$407

$348

16.8%

$307

$297

3.3%

75.5%

85.3%

(9.9)

49,758

50,582

(1.6)%

Tennessee

$1,135

$1,109

2.4%

$845

$848

(0.4)%

72.8%

81.5%

(8.7)

150,693

156,233

(3.5)%

Texas

$6,511

$6,232

4.5%

$5,731

$5,205

10.1%

88.0%

88.3%

(0.3)

1,343,817

1,245,826

7.9%

Utah

$1,371

$1,171

17.1%

$905

$967

(6.4)%

66.0%

83.1%

(17.1)

226,301

226,987

(0.3)%

Vermont

$258

$230

12.0%

$210

$215

(2.2)%

81.6%

93.3%

(11.8)

31,263

31,643

(1.2)%

Virginia

$1,803

$1,741

3.6%

$1,172

$1,193

(1.8)%

67.9%

69.1%

(1.2)

249,937

219,468

13.9%

Washington

$1,576

$1,618

(2.6)%

$1,192

$1,198

(0.5)%

75.9%

75.3%

0.6

277,267

235,846

17.6%

West Virginia

$289

$241

20.3%

$181

$182

(0.5)%

62.6%

75.7%

(13.1)

18,889

19,484

(3.1)%

Wisconsin

$1,767

$1,815

(2.7)%

$1,399

$1,426

(1.9)%

81.4%

78.6%

2.8

202,951

197,543

2.7%

Wyoming

$305

$302

0.9%

$223

$219

1.8%

70.7%

72.4%

(1.6)

25,938

28,520

(9.1)%

American Samoa

-

-

0.0%

-

-

0.0%

0.0%

0.0%

0.0

-

-

0.0%

Guam

$1

$1

(13.3)%

-

-

0.0%

0.0%

0.0%

0.0

11

8

37.5%

Northern Mariana Islands

$2

$2

(7.6)%

-

-

0.0%

0.0%

0.0%

0.0

2

3

(33.3)%

Puerto Rico

$342

$306

11.8%

$303

$260

16.7%

228.3%

232.7%

(4.3)

205,861

340,327

(39.5)%

U.S. Virgin Islands

$1

$1

(8.4)%

$1

$1

(41.2)%

75.9%

91.0%

(15.1)

229

278

(17.6)%

Aggregate Other Alien

$3,225

$739

336.7%

$48

$65

(25.7)%

1.5%

8.8%

(7.3)

17,140

18,461

(7.2)%

Grand Totals

$78,232

$72,722

7.6%

$58,519

$56,669

3.3%

75.0%

79.6%

(4.6)

11,942,107

11,656,807

2.4%

*Based on earned premium. This loss ratio should not to be confused with the Preliminary MLR on the Supplemental Health Care Exhbit.

ClaimsDirect Written Premium Loss Ratio*

Table 4 - Individual Comprehensive Hospital & Medical

As reported in the

Exhibit of Premiums, Enrollment and Utilization

Enrollment

U.S. Health Insurance Industry | 2020 Annual Results

14 | P a g e

© 2021 National Association of Insurance Commissioners

($ in Millions except Enrollment)

State 2020 2019 % Chg. 2020 2019 % Chg. 2020 2019

%

Pt Chg.

2020 2019

Alabama

$3,015

$2,868

5.1%

$2,789

$2,618

6.5%

91.8%

92.0%

(0.2)

615,589

609,165

1.1%

Alaska

$300

$292

2.4%

$246

$219

12.5%

81.8%

75.8%

6.0

34,685

32,740

5.9%

Arizona

$1,393

$1,355

2.8%

$1,119

$1,065

5.1%

80.5%

78.4%

2.1

280,646

282,050

(0.5)%

Arkansas

$1,053

$1,122

(6.2)%

$847

$925

(8.5)%

80.3%

82.4%

(2.1)

219,815

239,177

(8.1)%

California

$524

$652

(19.6)%

$411

$554

(25.7)%

81.4%

88.6%

(7.2)

91,722

89,132

2.9%

Colorado

$3,104

$3,160

(1.8)%

$2,607

$2,759

(5.5)%

84.2%

87.4%

(3.2)

540,779

578,544

(6.5)%

Connecticut

$1,776

$1,888

(6.0)%

$1,459

$1,609

(9.3)%

82.2%

85.2%

(3.0)

233,531

259,358

(10.0)%

Delaware

$305

$373

(18.1)%

$235

$284

(17.3)%

80.2%

76.1%

4.1

43,461

49,241

(11.7)%

District of Columbia

$1,470

$1,420

3.5%

$1,146

$1,140

0.5%

78.7%

81.0%

(2.3)

217,795

232,889

(6.5)%

Florida

$9,323

$9,945

(6.3)%

$7,831

$8,561

(8.5)%

83.1%

86.1%

(2.9)

1,387,227

1,500,892

(7.6)%

Georgia

$4,248

$4,317

(1.6)%

$3,804

$3,890

(2.2)%

119.5%

90.1%

29.3

808,172

894,652

(9.7)%

Hawaii

$3,078

$3,155

(2.5)%

$2,666

$2,818

(5.4)%

86.8%

89.5%

(2.7)

646,841

694,073

(6.8)%

Idaho

$1,208

$1,192

1.3%

$1,026

$1,020

0.6%

85.6%

85.4%

0.2

244,870

246,288

(0.6)%

Illinois

$11,002

$10,979

0.2%

$9,753

$9,327

0.0%

88.2%

84.8%

3.4

1,926,906

1,948,114

(1.1)%

Indiana

$1,721

$1,771

(2.8)%

$1,381

$1,479

(6.6)%

80.7%

83.1%

(2.4)

296,736

325,482

(8.8)%

Iowa

$2,116

$2,117

(0.0)%

$1,717

$1,723

(0.3)%

82.0%

81.6%

0.4

380,794

395,501

(3.7)%

Kansas

$534

$547

(2.4)%

$413

$421

(1.8)%

77.0%

76.8%

0.2

164,274

186,497

(11.9)%

Kentucky

$1,873

$1,891

(0.9)%

$1,548

$1,579

(2.0)%

82.9%

83.6%

(0.7)

330,428

350,599

(5.8)%

Louisiana

$2,514

$2,463

2.1%

$2,042

$2,109

(3.2)%

81.3%

85.7%

(4.4)

424,605

446,904

(5.0)%

Maine

$1,155

$1,145

0.9%

$919

$986

(6.8)%

82.2%

86.0%

(3.8)

170,374

183,353

(7.1)%

Maryland

$3,037

$3,057

(0.7)%

$2,410

$2,457

(1.9)%

80.0%

80.9%

(0.9)

531,773

563,986

(5.7)%

Massachusetts

$8,679

$8,758

(0.9)%

$7,014

$7,545

(7.0)%

81.0%

86.4%

(5.4)

1,272,387

1,354,497

(6.1)%

Michigan

$9,108

$9,126

(0.2)%

$7,610

$7,738

(1.7)%

83.9%

84.9%

(1.0)

1,758,041

1,787,807

(1.7)%

Minnesota

$4,217

$4,368

(3.5)%

$3,499

$3,790

(7.7)%

83.0%

86.8%

(3.8)

833,808

915,288

(8.9)%

Mississippi

$899

$862

4.3%

$749

$771

(2.8)%

83.3%

89.4%

(6.1)

187,690

196,332

(4.4)%

Missouri

$2,039

$2,342

(12.9)%

$1,619

$1,965

(17.6)%

79.7%

82.8%

(3.1)

418,038

510,401

(18.1)%

Montana

$485

$453

7.1%

$394

$376

4.8%

81.3%

83.5%

(2.2)

82,808

85,055

(2.6)%

Nebraska

$1,023

$1,006

1.7%

$873

$853

2.4%

85.8%

84.3%

1.5

161,606

166,628

(3.0)%

Nevada

$1,767

$1,761

0.3%

$1,461

$1,402

4.2%

82.4%

79.7%

2.7

365,909

386,906

(5.4)%

New Hampshire

$1,050

$1,066

(1.5)%

$820

$850

(3.5)%

78.6%

79.9%

(1.3)

158,488

162,020

(2.2)%

New Jersey

$5,671

$5,926

(4.3)%

$4,577

$4,924

(7.0)%

81.0%

83.5%

(2.5)

733,330

812,975

(9.8)%

New Mexico

$523

$556

(6.1)%

$432

$466

(7.2)%

83.2%

84.2%

(1.0)

82,302

88,745

(7.3)%

New York

$17,714

$17,569

0.8%

$14,661

$14,847

(1.3)%

82.5%

84.5%

(2.0)

2,407,485

2,540,321

(5.2)%

North Carolina

$2,753

$2,828

(2.7)%

$2,316

$2,363

(2.0)%

84.2%

83.5%

0.6

519,621

542,127

(4.2)%

North Dakota

$1,079

$1,058

2.0%

$932

$959

(2.8)%

86.3%

90.7%

(4.3)

189,122

197,482

(4.2)%

Ohio

$5,054

$4,876

3.7%

$4,139

$4,110

0.7%

81.9%

84.3%

(2.4)

862,585

869,566

(0.8)%

Oklahoma

$1,832

$1,824

0.5%

$1,538

$1,466

5.0%

82.1%

82.0%

0.1

352,703

345,863

2.0%

Oregon

$4,283

$4,229

1.3%

$3,489

$3,710

(6.0)%

81.5%

87.6%

(6.2)

726,460

755,134

(3.8)%

Pennsylvania

$8,502

$8,703

(2.3)%

$7,017

$7,509

0.0%

82.7%

86.2%

(3.6)

1,377,030

1,489,198

(7.5)%

Rhode Island

$771

$806

(4.4)%

$638

$670

(4.8)%

82.7%

83.1%

(0.4)

122,115

130,411

(6.4)%

South Carolina

$1,785

$1,736

2.8%

$1,382

$1,417

(2.5)%

78.0%

82.2%

(4.2)

339,502

365,901

(7.2)%

South Dakota

$698

$678

2.9%

$567

$566

0.2%

81.3%

83.5%

(2.2)

120,148

122,128

(1.6)%

Tennessee

$2,423

$2,519

(3.8)%

$1,992

$2,008

(0.8)%

82.1%

79.9%

2.2

489,717

543,443

(9.9)%

Texas

$9,984

$9,532

4.7%

$8,669

$8,271

4.8%

86.8%

86.8%

(0.0)

1,881,919

1,930,577

(2.5)%

Utah

$1,779

$1,691

5.2%

$1,484

$1,467

1.1%

83.2%

86.6%

(3.4)

392,506

394,410

(0.5)%

Vermont

$342

$386

(11.3)%

$284

$354

(19.9)%

82.8%

91.6%

(8.8)

50,023

61,152

(18.2)%

Virginia

$3,929

$3,905

0.6%

$3,123

$3,213

(2.8)%

80.0%

83.2%

(3.2)

657,124

676,120

(2.8)%

Washington

$5,914

$5,891

0.4%

$4,822

$4,954

(2.7)%

81.5%

84.1%

(2.6)

1,052,913

1,066,258

(1.3)%

West Virginia

$607

$651

(6.8)%

$518

$543

(4.6)%

85.4%

83.5%

1.9

97,083

102,104

(4.9)%

Wisconsin

$4,916

$4,702

4.5%

$4,322

$4,346

(0.6)%

87.9%

92.5%

(4.5)

897,411

871,788

2.9%

Wyoming

$164

$170

(3.5)%

$136

$149

(9.2)%

81.7%

87.8%

(6.2)

24,116

24,735

(2.5)%

American Samoa

$1

$4

(61.1)%

$1

$2

(45.9)%

768.5%

55.3%

713.2

9

9

0.0%

Guam

$34

$53

(35.1)%

$43

$54

(20.7)%

129.8%

106.8%

23.0

9,695

12,460

(22.2)%

Northern Mariana Islands

$4

$4

(3.6)%

$4

$5

(13.5)%

110.3%

125.3%

(15.0)

1,203

2,439

(50.7)%

Puerto Rico

$842

$835

0.9%

$643

$688

(6.6)%

117.4%

127.6%

(10.3)

477,583

356,761

33.9%

U.S. Virgin Islands

$11

$11

0.2%

$7

$7

(5.5)%

62.3%

66.1%

(3.8)

2,030

2,108

(3.7)%

Aggregate Other Alien

$172

$65

163.3%

$2

$2

(13.8)%

1.1%

3.4%

(2.3)

2,775

2,572

7.9%

Grand Totals

$165,839

$166,717

(0.5)%

$138,099

$141,900

(2.7)%

84.0%

85.4%

(1.4)

28,683,793

29,980,358

(4.3)%

*Based on earned premium. This loss ratio should not to be confused with the Preliminary MLR on the Supplemental Health Care Exhbit.

% Chg.

Direct Written Premium Claims Loss Ratio*

Table 4 - Group Comprehensive Hospital & Medical

As reported in the

Exhibit of Premiums, Enrollment and Utilization

Enrollment

U.S. Health Insurance Industry | 2020 Annual Results

15 | P a g e

© 2021 National Association of Insurance Commissioners

($ in Millions except Enrollment)

State 2020 2019 % Chg. 2020 2019 % Chg. 2020 2019

%

Pt Chg.

2020 2019

Alabama

$248

$242

2.5%

$199

$221

(10.3)%

80.9%

93.3%

(12.4)

117,607

123,838

(5.0)%

Alaska

$6

$6

10.4%

$5

$4

1.3%

73.8%

80.4%

(6.7)

2,853

2,727

4.6%

Arizona

$144

$130

10.6%

$98

$97

1.3%

68.1%

74.3%

(6.2)

62,894

55,583

13.2%

Arkansas

$300

$276

8.5%

$220

$234

(6.3)%

73.3%

83.6%

(10.2)

128,607

126,822

1.4%

California

$48

$43

11.4%

$36

$37

(2.0)%

75.8%

86.2%

(10.4)

21,443

20,673

3.7%

Colorado

$89

$80

11.2%

$64

$61

4.9%

72.1%

75.9%

(3.8)

42,831

38,076

12.5%

Connecticut

$157

$140

11.9%

$113

$108

4.6%

72.3%

77.2%

(4.9)

60,712

55,601

9.2%

Delaware

$24

$23

6.5%

$16

$16

(3.4)%

64.2%

70.7%

(6.5)

11,653

10,237

13.8%

District of Columbia

$5

$5

7.3%

$4

$4

0.7%

76.9%

81.9%

(5.0)

2,279

2,203

3.4%

Florida

$537

$516

4.0%

$392

$415

(5.5)%

73.0%

80.4%

(7.3)

200,983

203,583

(1.3)%

Georgia

$220

$196

11.9%

$153

$149

2.6%

69.8%

76.1%

(6.3)

98,329

85,178

15.4%

Hawaii

$2

$2

(4.9)%

$3

$2

6.6%

109.7%

97.8%

11.8

992

1,271

(22.0)%

Idaho

$39

$37

5.3%

$29

$29

(1.5)%

74.8%

79.8%

(5.0)

15,211

14,579

4.3%

Illinois

$1,023

$1,014

0.9%

$734

$798

0.0%

70.6%

79.1%

(8.5)

393,439

374,810

5.0%

Indiana

$158

$153

3.3%

$106

$112

(5.6)%

67.1%

73.2%

(6.1)

62,048

59,140

4.9%

Iowa

$445

$427

4.1%

$371

$366

1.3%

83.4%

85.7%

(2.3)

190,996

180,908

5.6%

Kansas

$47

$33

40.7%

$34

$25

32.5%

72.5%

76.8%

(4.3)

26,646

14,069

89.4%

Kentucky

$196

$185

6.1%

$131

$140

(6.2)%

66.8%

75.5%

(8.7)

79,158

79,207

(0.1)%

Louisiana

$123

$117

5.4%

$94

$96

(2.4)%

76.1%

82.2%

(6.1)

52,908

47,397

11.6%

Maine

$65

$61

7.9%

$48

$51

(5.0)%

73.5%

84.4%

(10.8)

26,720

26,200

2.0%

Maryland

$183

$180

1.8%

$119

$132

(10.1)%

65.2%

73.8%

(8.6)

65,549

61,347

6.8%

Massachusetts

$754

$724

4.1%

$620

$668

(7.2)%

82.2%

92.2%

(10.0)

316,833

312,297

1.5%

Michigan

$484

$504

(4.1)%

$363

$420

(13.7)%

74.9%

83.3%

(8.4)

165,475

171,951

(3.8)%

Minnesota

$541

$537

0.8%

$386

$441

(12.5)%

71.4%

82.2%

(10.8)

188,172

195,350

(3.7)%

Mississippi

$42

$40

5.6%

$34

$36

(5.4)%

81.3%

90.7%

(9.4)

16,215

14,328

13.2%

Missouri

$156

$144

8.0%

$112

$111

0.6%

71.7%

76.8%

(5.2)

61,539

57,272

7.5%

Montana

$76

$66

15.7%

$48

$50

(4.3)%

68.0%

75.5%

(7.4)

29,376

27,415

7.2%

Nebraska

$174

$174

(0.0)%

$121

$136

(11.4)%

69.3%

78.2%

(8.9)

60,842

61,704

(1.4)%

Nevada

$34

$33

5.6%

$23

$24

(4.5)%

66.3%

73.7%

(7.5)

13,893

12,977

7.1%

New Hampshire

$113

$106

5.9%

$79

$86

(8.6)%

70.0%

80.6%

(10.6)

46,351

44,297

4.6%

New Jersey

$332

$321

3.5%

$245

$258

(5.0)%

73.6%

80.1%

(6.4)

124,392

115,493

7.7%

New Mexico

$22

$22

1.5%

$15

$16

(5.9)%

69.4%

76.4%

(7.0)

9,635

9,221

4.5%

New York

$1,320

$1,292

2.2%

$976

$1,049

(6.9)%

78.3%

80.1%

(1.8)

449,832

453,153

(0.7)%

North Carolina

$424

$405

4.7%

$302

$304

(0.6)%

71.2%

75.0%

(3.7)

183,464

168,285

9.0%

North Dakota

$108

$102

5.1%

$77

$84

(8.0)%

71.4%

81.5%

(10.2)

40,984

40,400

1.4%

Ohio

$538

$473

13.6%

$401

$380

5.3%

74.6%

80.6%

(5.9)

261,781

251,292

4.2%

Oklahoma

$150

$145

3.5%

$113

$115

(1.9)%

74.2%

80.1%

(5.9)

67,100

63,777

5.2%

Oregon

$96

$127

(23.8)%

$72

$103

(29.9)%

75.1%

81.7%

(6.6)

44,757

40,336

11.0%

Pennsylvania

$379

$377

0.6%

$290

$318

0.0%

76.7%

84.3%

(7.7)

201,593

186,683

8.0%

Rhode Island

$63

$62

1.7%

$45

$54

(16.7)%

72.1%

88.0%

(15.9)

25,945

26,670

(2.7)%

South Carolina

$181

$166

8.8%

$124

$118

4.9%

68.6%

71.1%

(2.5)

86,340

73,704

17.1%

South Dakota

$82

$81

0.9%

$67

$68

(1.0)%

82.1%

83.7%

(1.6)

36,193

35,401

2.2%

Tennessee

$297

$290

2.5%

$209

$216

(2.8)%

70.4%

74.3%

(3.9)

125,531

121,585

3.2%

Texas

$529

$458

15.5%

$389

$353

10.1%

73.5%

77.9%

(4.4)

244,652

202,755

20.7%

Utah

$58

$55

6.7%

$39

$39

(1.1)%

66.7%

71.9%

(5.1)

25,410

23,415

8.5%

Vermont

$33

$31

8.6%

$23

$24

(4.2)%

70.1%

79.5%

(9.4)

15,071

14,174

6.3%

Virginia

$357

$335

6.6%

$242

$252

(4.0)%

67.7%

75.2%

(7.5)

158,529

150,506

5.3%

Washington

$284

$243

16.8%

$188

$176

6.8%

66.3%

72.6%

(6.2)

121,507

102,278

18.8%

West Virginia

$27

$26

5.0%

$21

$22

(1.2)%

78.7%

83.7%

(5.0)

10,871

10,771

0.9%

Wisconsin

$310

$298

4.1%

$207

$216

(4.0)%

67.0%

72.6%

(5.6)

99,211

91,205

8.8%

Wyoming

$27

$26

3.9%

$20

$21

(5.6)%

72.2%

79.5%

(7.3)

11,728

11,671

0.5%

American Samoa

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Guam

-

-

0.0%

-

-

0.0%

235.0%

0.0%

235.0

-

-

0.0%

Northern Mariana Islands

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Puerto Rico

$15

$16

(4.7)%

$10

$14

(29.2)%

62.1%

83.7%

(21.5)

9,712

11,101

(12.5)%

U.S. Virgin Islands

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Aggregate Other Alien

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Grand Totals

$12,041

$11,546

4.3%

$8,811

$9,274

(5.0)%

73.6%

80.3%

(6.7)

4,903,622

4,684,916

4.7%

*Based on earned premium. This loss ratio should not to be confused with the Preliminary MLR on the Supplemental Health Care Exhbit.

% Chg.

Direct Written Premium Claims Loss Ratio*

Table 4 - Medicare Supplement

As reported in the

Exhibit of Premiums, Enrollment and Utilization

Enrollment

U.S. Health Insurance Industry | 2020 Annual Results

16 | P a g e

© 2021 National Association of Insurance Commissioners

($ in Millions except Enrollment)

State 2020 2019 % Chg. 2020 2019 % Chg. 2020 2019

%

Pt Chg.

2020 2019

Alabama

$43

$42

0.9%

$26

$28

(6.6)%

61.4%

66.4%

(4.9)

537,304

523,378

2.7%

Alaska

$3

$3

(4.1)%

$2

$2

(15.8)%

57.5%

65.5%

(8.0)

32,293

34,033

(5.1)%

Arizona

$62

$64

(3.1)%

$42

$50

(14.9)%

67.5%

76.9%

(9.4)

1,076,890

1,113,523

(3.3)%

Arkansas

$21

$23

(9.5)%

$12

$15

(20.3)%

57.4%

65.3%

(7.8)

211,710

195,107

8.5%

California

$50

$45

10.2%

$24

$27

(10.1)%

49.1%

60.2%

(11.1)

679,167

638,118

6.4%

Colorado

$59

$64

(7.8)%

$39

$45

(12.6)%

67.4%

71.2%

(3.7)

855,847

875,649

(2.3)%

Connecticut

$36

$36

(1.6)%

$26

$28

(7.8)%

73.2%

78.0%

(4.9)

499,732

505,052

(1.1)%

Delaware

$11

$12

(4.4)%

$8

$9

(16.4)%

66.1%

75.6%

(9.5)

145,395

158,690

(8.4)%

District of Columbia

$16

$15

6.5%

$13

$13

0.6%

82.3%

87.2%

(4.8)

54,025

53,376

1.2%

Florida

$145

$133

8.9%

$86

$97

(10.8)%

59.6%

72.8%

(13.2)

2,128,862

2,097,742

1.5%

Georgia

$91

$88

3.3%

$59

$62

(5.9)%

64.7%

71.1%

(6.4)

1,235,466

1,186,522

4.1%

Hawaii

$12

$12

(3.4)%

$9

$11

(13.4)%

78.1%

87.2%

(9.1)

0

0

0.0%

Idaho

$17

$17

(4.4)%

$10

$11

(9.7)%

61.5%

65.1%

(3.6)

203,369

206,693

(1.6)%

Illinois

$163

$157

3.7%

$119

$126

0.0%

73.4%

80.1%

(6.7)

2,202,898

2,127,710

3.5%

Indiana

$63

$67

(6.2)%

$43

$49

(11.0)%

69.4%

73.2%

(3.8)

976,855

1,002,091

(2.5)%

Iowa

$13

$13

(1.0)%

$8

$9

(6.8)%

64.8%

68.8%

(4.0)

161,335

159,562

1.1%

Kansas

$16

$15

6.4%

$11

$11

(0.6)%

67.0%

71.7%

(4.7)

207,569

181,450

14.4%

Kentucky

$41

$40

2.7%

$25

$27

(5.4)%

62.5%

68.0%

(5.5)

589,823

568,118

3.8%

Louisiana

$24

$22

4.8%

$16

$16

(0.3)%

66.4%

69.7%

(3.4)

319,681

309,693

3.2%

Maine

$13

$14

(4.6)%

$9

$10

(12.7)%

66.0%

72.1%

(6.1)

239,175

241,171

(0.8)%

Maryland

$53

$52

1.6%

$38

$38

(0.9)%

71.2%

72.9%

(1.8)

560,491

553,842

1.2%

Massachusetts

$52

$51

1.9%

$31

$35

(10.5)%

60.3%

68.6%

(8.3)

733,731

709,143

3.5%

Michigan

$104

$109

(5.0)%

$73

$86

(15.2)%

76.0%

83.9%

(7.9)

2,232,055

2,273,868

(1.8)%

Minnesota

$50

$51

(1.0)%

$35

$39

(9.2)%

70.2%

76.5%

(6.3)

678,053

660,458

2.7%

Mississippi

$10

$10

6.0%

$6

$7

(3.0)%

61.2%

66.9%

(5.7)

143,416

133,871

7.1%

Missouri

$134

$127

5.4%

$76

$78

(2.9)%

57.1%

62.0%

(4.9)

1,339,671

1,280,072

4.7%

Montana

$4

$4

(3.7)%

$2

$2

(6.7)%

60.3%

62.3%

(2.0)

67,309

69,670

(3.4)%

Nebraska

$8

$9

(15.5)%

$6

$7

(19.0)%

70.9%

74.0%

(3.0)

96,533

121,170

(20.3)%

Nevada

$14

$14

(1.5)%

$9

$10

(8.4)%

64.9%

69.8%

(4.9)

192,269

188,378

2.1%

New Hampshire

$8

$10

(19.1)%

$4

$6

(29.2)%

54.7%

62.5%

(7.8)

110,310

138,750

(20.5)%

New Jersey

$89

$90

(1.0)%

$63

$70

(9.9)%

71.5%

78.6%

(7.1)

1,230,563

1,220,107

0.9%

New Mexico

$10

$13

(20.9)%

$6

$8

(28.5)%

58.1%

64.3%

(6.2)

134,774

162,336

(17.0)%

New York

$120

$118

1.8%

$79

$89

(10.9)%

65.9%

75.3%

(9.5)

1,753,176

1,698,916

3.2%

North Carolina

$92

$91

1.2%

$64

$70

(7.8)%

70.0%

76.8%

(6.8)

1,126,285

1,068,748

5.4%

North Dakota

$7

$7

(3.8)%

$4

$5

(7.7)%

62.1%

64.8%

(2.6)

71,640

74,816

(4.2)%

Ohio

$139

$143

(3.2)%

$96

$105

(8.7)%

69.3%

73.5%

(4.1)

1,946,049

1,952,235

(0.3)%

Oklahoma

$49

$51

(4.1)%

$35

$37

(5.5)%

70.9%

71.9%

(1.0)

630,725

631,841

(0.2)%

Oregon

$25

$26

(4.6)%

$14

$16

(11.8)%

58.1%

62.8%

(4.7)

326,363

332,994

(2.0)%

Pennsylvania

$139

$143

(2.7)%

$95

$112

0.0%

68.1%

78.5%

(10.4)

1,782,487

1,811,581

(1.6)%

Rhode Island

$19

$30

(35.4)%

$12

$24

(50.0)%

63.5%

82.0%

(18.5)

165,111

354,459

(53.4)%

South Carolina

$38

$39

(3.9)%

$29

$29

(0.2)%

77.3%

74.4%

2.8

590,027

535,164

10.3%

South Dakota

$14

$14

5.2%

$10

$11

(6.0)%

77.2%

86.6%

(9.3)

173,280

172,884

0.2%

Tennessee

$69

$69

(0.1)%

$50

$48

3.4%

72.1%

69.7%

2.5

1,037,653

1,047,003

(0.9)%

Texas

$210

$223

(5.9)%

$170

$192

(11.2)%

81.2%

86.1%

(4.9)

3,029,754

3,163,407

(4.2)%

Utah

$21

$20

2.8%

$13

$13

(2.9)%

61.1%

64.8%

(3.6)

346,044

344,393

0.5%

Vermont

$6

$5

8.5%

$3

$3

(6.9)%

57.8%

67.3%

(9.5)

74,847

70,144

6.7%

Virginia

$112

$108

3.5%

$79

$83

(4.4)%

71.0%

76.6%

(5.6)

1,353,852

1,270,269

6.6%

Washington

$54

$68

(20.8)%

$33

$48

(30.9)%

61.7%

70.7%

(9.0)

946,697

1,044,567

(9.4)%

West Virginia

$5

$6

(14.0)%

$4

$4

(16.6)%

68.4%

70.5%

(2.2)

47,478

47,106

0.8%

Wisconsin

$69

$70

(1.1)%

$44

$48

(8.7)%

64.2%

69.5%

(5.3)

1,029,059

1,010,509

1.8%

Wyoming

$1

$3

0.0%

$3

$3

(6.4)%

59.9%

78.3%

(18.3)

434

495

(12.3)%

American Samoa

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Guam

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Northern Mariana Islands

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Puerto Rico

$1

$4

(63.8)%

$3

$1

222.0%

24.8%

0.0%

24.8

3,403

517

558.2%

U.S. Virgin Islands

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Aggregate Other Alien

-

-

0.0%

-

-

0.0%

-

-

0.0

-

-

0.0%

Grand Totals

$2,619

$2,654

(1.3)%

$1,774

$1,969

(9.9)%

68.0%

74.5%

(6.5)

36,310,935

36,321,391

(0.0)%

*Based on earned premium. This loss ratio should not to be confused with the Preliminary MLR on the Supplemental Health Care Exhbit.

% Chg.

Direct Written Premium Claims Loss Ratio*

Table 4 - Vision Coverage

As reported in the

Exhibit of Premiums, Enrollment and Utilization

Enrollment

U.S. Health Insurance Industry | 2020 Annual Results

17 | P a g e

© 2021 National Association of Insurance Commissioners

($ in Millions except Enrollment)

State 2020 2019 % Chg. 2020 2019 % Chg. 2020 2019

%

Pt Chg.

2020 2019

Alabama

$187

$189

(1.2)%

$125

$147

(15.2)%

67.8%

77.9%

(10.1)

653,081

652,214

0.1%

Alaska

$18

$16

10.8%

$12

$13

(2.1)%

70.2%

79.5%

(9.4)

35,479

36,263

(2.2)%

Arizona

$187

$185

1.1%

$120

$131

(8.5)%

64.5%

71.2%

(6.7)

663,825

666,041

(0.3)%

Arkansas

$181

$192

(5.6)%

$123

$145

(15.1)%

68.2%

75.5%

(7.3)

483,963

468,860

3.2%

California

$583

$579

0.8%

$339

$398

(15.0)%

58.3%

69.0%

(10.6)

1,167,398

1,144,503

2.0%

Colorado

$772

$789

(2.2)%

$646

$741

(12.8)%

85.8%

94.9%

(9.1)

2,585,764

2,611,233

(1.0)%

Connecticut

$81

$82

(1.8)%

$50

$58

(13.6)%

62.1%

70.6%

(8.5)

209,897

208,863

0.5%

Delaware

$53

$60

(12.1)%

$37

$49

(23.4)%

68.9%

80.7%

(11.8)

124,731

140,937

(11.5)%

District of Columbia

$398

$364

9.2%

$268

$306

(12.3)%

67.7%

84.0%

(16.3)

890,516

879,527

1.2%

Florida

$485

$480

1.1%

$323

$344

(6.2)%

69.8%

71.9%

(2.1)

1,967,085

1,983,574

(0.8)%

Georgia

$360

$344

4.6%

$238

$258

(7.8)%

69.9%

75.4%

(5.5)

1,049,346

1,010,387

3.9%

Hawaii

$61

$63

(4.1)%

$39

$45

(13.7)%

63.8%

70.9%

(7.1)

2,387

2,455

(2.8)%

Idaho

$121

$115

4.9%

$94

$95

(1.8)%

77.9%

83.0%

(5.1)

248,405

234,283

6.0%

Illinois

$471

$446

5.6%

$299

$322

0.0%

63.7%

72.4%

(8.7)

1,313,114

1,274,201

3.1%

Indiana

$208

$208

0.1%

$148

$162

(8.5)%

71.3%

101.0%

(29.7)

710,606

713,192

(0.4)%

Iowa

$34

$32

5.1%

$22

$25

(13.4)%

64.2%

77.9%

(13.7)

97,003

94,409

2.7%

Kansas

$112

$121

(7.4)%

$87

$93

(7.0)%

534.9%

608.5%

(73.7)

328,002

328,055

(0.0)%

Kentucky

$251

$220

14.1%

$172

$186

(7.2)%

68.7%

84.4%

(15.7)

959,532

920,312

4.3%

Louisiana

$120

$113

6.3%

$88

$97

(8.9)%

75.7%

86.2%

(10.5)

392,238

389,295

0.8%